Euro Resurgence: Investor Confidence, Capital Inflows, and the Rebalancing of Global Currency Dynamics

The euro has surged to multi-year highs against the dollar amid improving investor sentiment, diverging central bank policies, and rising capital inflows. This article explores what's driving the rally—and whether it can last.

The euro has broken through a major psychological barrier, climbing above $1.16 against the U.S. dollar for the first time since late 2021. This surge is not merely a technical blip—it’s a confluence of recovering eurozone sentiment, diverging monetary policies, capital flows, and escalating global trade tensions. While short-term momentum is strong, critical questions persist about the sustainability and breadth of this recovery across the euro area.

Investor Confidence Breaks Out of Negative Territory

Investor sentiment in the eurozone has flipped positive for the first time in a year, with the Sentix Investor Confidence Index rising sharply from -8.1 in May to 0.2 in June 2025. This 8.3-point leap surprised markets and marks the highest reading since June 2024.

The improvement is anchored in Germany, where a conservative-led government has boosted confidence. Hopes for a ceasefire in Ukraine and easing U.S. trade tensions have further supported the rebound.

Tariffs: A Renewed Threat to Global Equilibrium

Rising protectionist rhetoric—especially from former President Trump—has become a key driver of global financial shifts. With a July 9 deadline looming for U.S. trading partners to renegotiate terms, Trump has threatened unilateral tariffs on nations that fail to comply. This has injected considerable volatility into currency and equity markets, prompting investors to reallocate capital to regions perceived as more stable, including Europe.

These looming tariffs have weakened the dollar, reinforcing the euro’s rise. For the eurozone, which is highly export-dependent, the geopolitical calculus remains delicate. European policymakers now find themselves needing to balance their internal recovery with external trade vulnerabilities.

A Diverging Policy Landscape: ECB Cuts, Fed Holds

While eurozone sentiment rises, the European Central Bank (ECB) and U.S. Federal Reserve are taking markedly different paths. The ECB cut its key rate to 2.00% in June and is expected to ease further to 1.5% by year-end. In contrast, the Fed remains cautious, holding rates steady at 4.25%–4.50% amid persistent domestic inflation.

This divergence has broader implications. A weaker euro raises the cost of dollar-priced imports, potentially inflating eurozone prices in the short term. Over time, however, tighter U.S. monetary policy tends to suppress both domestic and international inflation through demand transmission.

Breaking Through $1.16: What’s Behind the Euro Rally?

The euro’s recent rally is as much about U.S. weakness as it is about European strength. A combination of soft U.S. inflation data and growing expectations of Fed rate cuts has weakened the greenback. Markets are now pricing in a 60% probability of a 25-basis-point cut by the Fed in September.

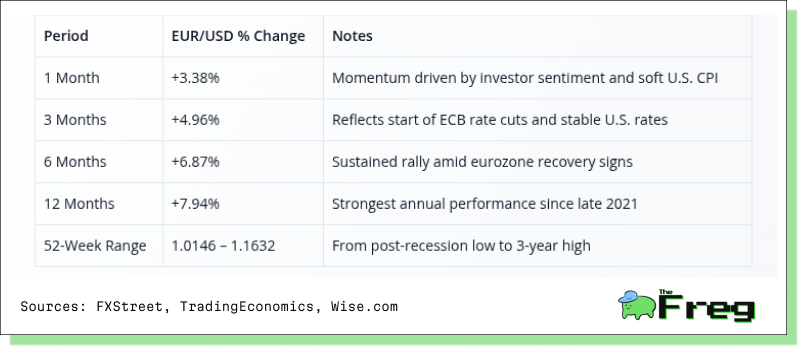

The euro has posted strong gains across all key timeframes, driven by improving eurozone sentiment, easing ECB policy, and weakening U.S. dollar momentum. Its breakout above 1.16 marks a significant recovery from early-2024 lows, reflecting investor confidence and capital flows into Europe.

Stock Market Characteristics: A Historical Lens

Capital shifts toward Europe represent a reversal of over a decade of underperformance. Between 2012 and 2022, U.S. equities consistently outpaced European markets, fuelled by tech-led growth and favourable macro conditions. However, the narrative has changed.

Since November 2024, the Stoxx 600 has outperformed the S&P 500 by 3 percentage points. This trend accelerated in early 2025 amid U.S. policy volatility and more attractive European valuations.

Asset Class Preferences: Where the Capital Is Going

The capital migration isn’t limited to equities. Investors are favoring a diverse range of eurozone assets, particularly those perceived as undervalued or insulated from global macro shocks:

- Equities: €26 billion flowed into European equity funds in Q1 2025 alone, the first net inflow since 2021.

- ETFs: Euro-denominated equity ETFs attracted €19.1 billion between April and May.

- Sovereign Bonds: With the ECB's rate cuts, demand for higher-yielding periphery bonds (Italy, Spain, Greece) has increased.

- Alternatives & Infrastructure: Renewables and logistics infrastructure are drawing in long-term capital, partly due to EU’s Green Deal initiatives.

Can the Recovery Extend Beyond Germany?

While Germany’s resurgence has lifted sentiment across the bloc, underlying disparities remain. Service and retail sectors are stagnating in peripheral economies such as Italy and the Netherlands, and construction activity remains a drag on growth.

ECB officials note that “investor sentiment has proven more resilient towards the euro area than other economies.” Yet for this rebound to endure, optimism must translate into real growth across a wider regional spectrum.

Euro's Broad-Based Strength: Cross-Currency Momentum

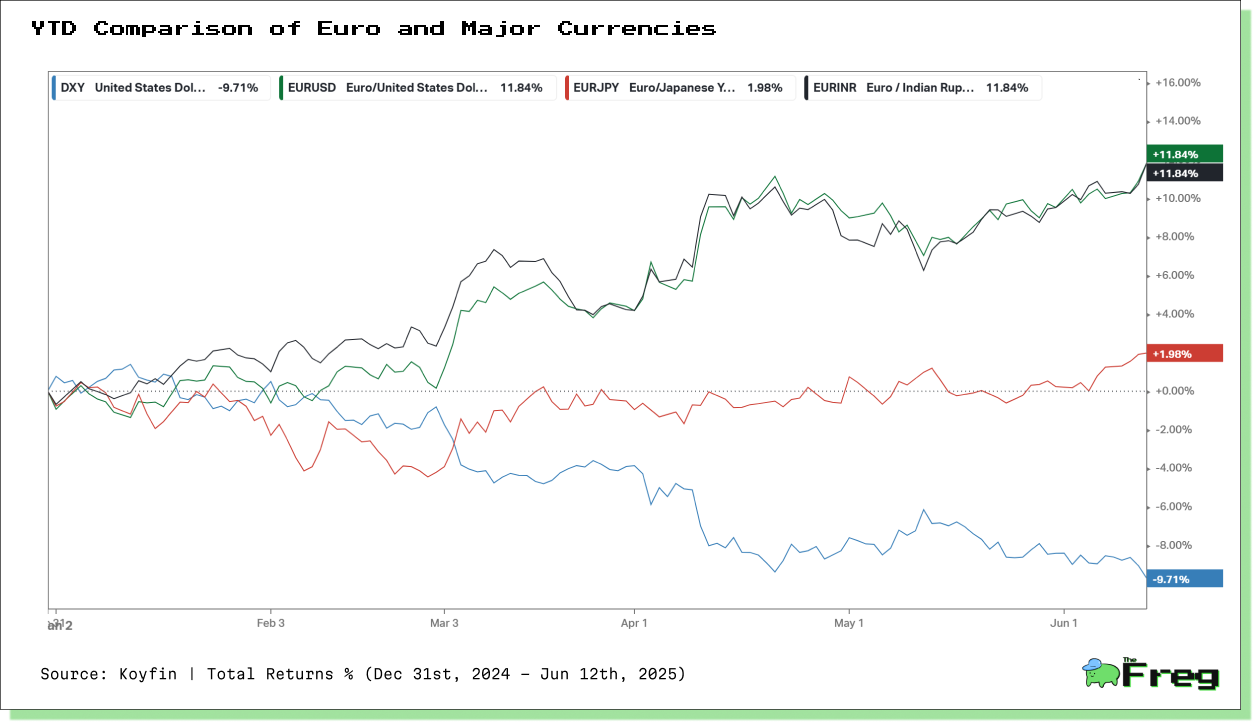

The chart above underscores the euro’s strong performance across major currency pairs over the past several months. Both EUR/USD and EUR/INR have surged +11.84%, reflecting the euro’s resilience not only against the dollar but also emerging market currencies. In contrast, EUR/JPY posted a modest gain of +1.98%, signaling a relatively stable yen.

Meanwhile, the U.S. Dollar Index (DXY) declined -9.71%, highlighting broader dollar weakness driven by trade policy uncertainty and shifting Fed expectations. This divergence illustrates how the euro’s rally is not merely a mirror image of USD depreciation but part of a wider capital reallocation favoring the eurozone

Outlook: Measured Optimism With Underlying Fragilities

The euro’s rally above $1.16 is a potent symbol of Europe’s growing appeal amid global volatility. With sentiment rebounding, monetary divergence favoring European assets, and capital flowing steadily into undervalued markets, the stage seems set for further gains.

Yet risks remain. Trade tensions, fragmented recovery across member states, and inflation uncertainty could all limit momentum. For now, Europe appears to be regaining investor confidence—but sustaining it will require more than a weak dollar and dovish central bank.