Debt Funds vs Fixed Deposits: Why Conservative Investors Are Rebalancing in 2025

In 2025, conservative investors are increasingly shifting from fixed deposits to debt mutual funds. This article compares returns, taxation, and liquidity, highlighting why debt funds are gaining favor amid changing interest rates and tax dynamics.

As India’s interest rate landscape shifts in 2025, a quiet revolution is unfolding in fixed-income investing. Conservative savers—long faithful to the safety of bank fixed deposits (FDs)—are now reconsidering their choices. Over 260 debt mutual funds have outperformed fixed deposit returns in the past two years, a trend driven by falling interest rates and a favorable bond market environment.

The catalyst? Recent rate cuts by the State Bank of India (SBI) and a broader pivot in monetary policy by the Reserve Bank of India (RBI). This environment has reignited interest in debt mutual funds, which offer not just potentially higher returns, but also tax and liquidity advantages that traditional FDs can’t match.

SBI’s FD Rate Cuts: A Tipping Point

In April and May 2025, SBI announced back-to-back rate cuts on its fixed deposits. After the most recent 20 basis point cut on May 16, FD interest rates for the general public now range from 3.30% to 6.70%, and from 3.80% to 7.30% for senior citizens.

The biggest impact has been on medium to long-term tenors. For example, the 5-10 year FD rate for senior citizens dropped from 7.50% to 7.30%. SBI’s “Amrit Vrishti” scheme, a high-profile deposit plan, was also revised downward—signaling a broader trend of softening deposit yields.

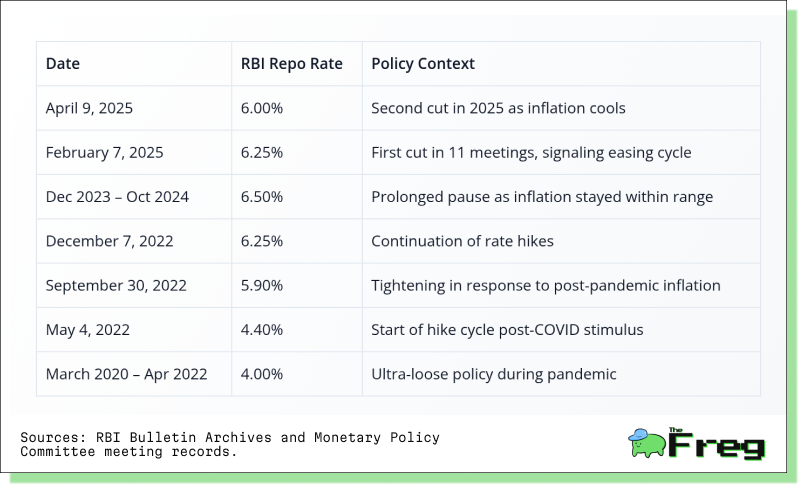

These cuts align with the RBI’s dovish stance. After maintaining the repo rate at 6.50% for 11 straight meetings, the central bank has slashed it by 50 basis points since February 2025 to 6.00%, in response to moderating inflation and slower growth.

A Favorable Interest Rate Cycle

Falling interest rates are a boon for debt mutual funds. As rates decline, bond prices rise, lifting the Net Asset Value (NAV) of these funds. Long-duration funds benefit the most, since their portfolios are packed with bonds that gain value as yields drop.

This rate environment has fueled strong returns across categories:

More than 260 debt funds have beaten SBI’s top FD rate of 6.7% over the past two years. Even conservative categories like banking & PSU and corporate bond funds are delivering returns in the 7–9% range—net of expense ratios.

Taxation: A Changing Yet Manageable Landscape

In 2023, the tax regime for debt mutual funds was overhauled. The indexation benefit was removed, aligning them with FDs in terms of tax slab applicability. Yet, critical differences remain:

- Timing of Tax: FD interest is taxed annually, regardless of withdrawal. Debt fund gains are taxed only on redemption, offering timing flexibility.

- TDS: FDs attract 10% TDS on interest above ₹40,000 (₹50,000 for seniors). Debt funds have no TDS on capital gains.

- Grandfathering Clause: Investments made before March 31, 2023 and held for over two years are taxed at a flat 12.5% if redeemed after July 23, 2024.

- Section 87A Update: Budget 2025 raised the rebate limit to ₹4 lakh, reducing tax liability for incomes up to ₹12 lakh.

These nuances make debt funds more attractive for investors in higher tax brackets, especially those seeking deferral and cash-flow flexibility.

Liquidity and Flexibility: The Debt Fund Edge

One of the biggest advantages debt funds hold over FDs is liquidity. Most funds allow redemption in 1–3 business days, and exit loads—if any—are limited to short holding periods. In contrast, premature withdrawal from FDs usually involves a penalty.

The most liquid category, liquid funds, invests in instruments maturing within 91 days—ideal for emergency funds or short-term parking.

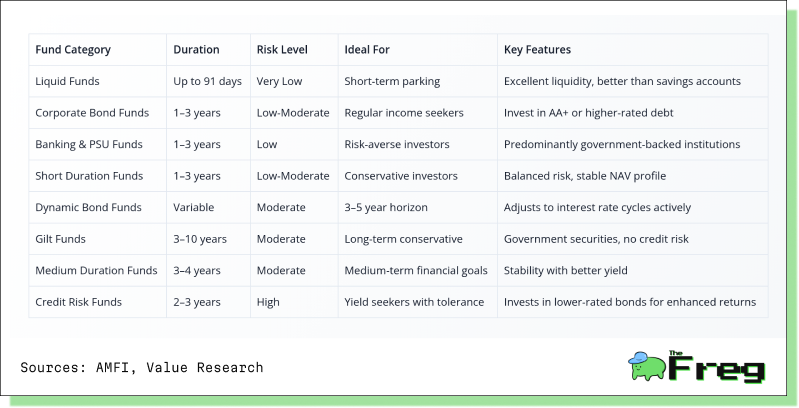

Fund Category Breakdown

Here's a snapshot of the key debt fund categories to guide allocation decisions:

Safety Guidelines for Riskier Funds

While credit risk funds have delivered outsized returns, they come with heightened default risk. To mitigate exposure:

- Limit allocation to 20–30% of your debt portfolio.

- Favor funds with higher AUM and diversified credit exposures.

- Study the fund manager’s history in navigating defaults.

- Avoid over-concentration in sectors like real estate or NBFCs.

For the risk-averse, stick with AAA-rated portfolios—such as corporate bond funds or banking & PSU funds.

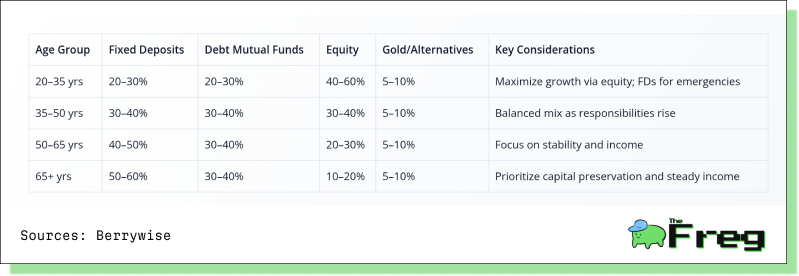

Age-Based Investment Strategies

An effective portfolio should evolve with age and financial goals. Here's a recommended allocation grid for conservative investors in 2025–26:

For goal-based planning:

- Short-Term (0–3 years): 70–80% in FDs and liquid/ultra-short funds.

- Medium-Term (3–7 years): Include 30–40% equity.

- Long-Term (7+ years): Up to 50–70% in equity or hybrid funds.

Strategic Diversification and Final Thoughts

Debt mutual funds should complement—not replace—FDs in a conservative portfolio. Their superior liquidity, potential for capital appreciation, and more efficient tax treatment make them a viable alternative, particularly in a falling interest rate cycle.

Experts now recommend allocating up to 50% of fixed-income portfolios to debt funds, especially for investors in higher tax brackets. Use SIPs or STPs to ease into market exposure and avoid timing pitfalls. Choose fund categories aligned with your time horizon: liquid funds for short-term needs, dynamic or gilt funds for longer tenors.

Repo Rate Timeline (2020–2025)

The trajectory of the RBI's repo rate underscores the opportunity for bond fund investors:

With more than 260 debt mutual funds outpacing FDs in the current rate cycle, conservative investors are finding compelling reasons to diversify their fixed-income strategies. While FDs still serve a valuable role in financial planning, debt funds offer a modern alternative that combines flexibility, potential for better returns, and efficient taxation. As India’s economic cycle evolves, so too must the investor’s approach to capital preservation and income generation.