China's Tariff Tempest: Can the Dragon Withstand the Storm?

The 2025 U.S.-China trade war has triggered economic chaos, with tariffs up to 145% disrupting exports, crippling Chinese factories, and reshaping global supply chains. As tech tensions rise and stimulus measures kick in, both nations face a high-stakes economic standoff.

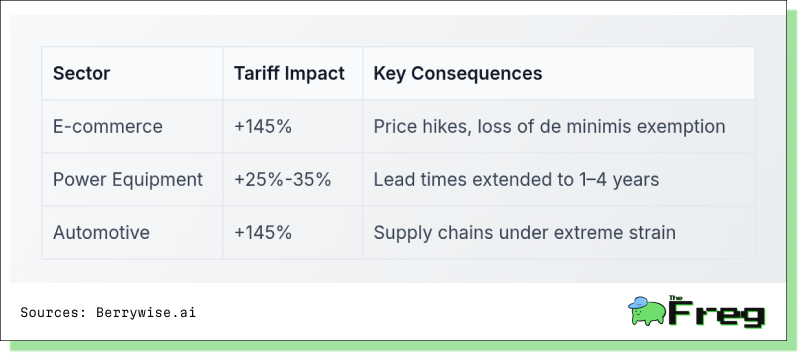

The year 2025 has seen the U.S.-China trade conflict explode into a full-blown economic firestorm. With tariffs soaring to 145% on Chinese exports to the United States and China hitting back with 125% levies on American goods, the world’s two largest economies have triggered a domino effect of economic distress, reverberating through factories, ports, supply chains, and global markets.

A Tsunami for China’s Manufacturing Base

The immediate impact of U.S. tariffs has been severe for China’s manufacturing sector, particularly for small- and mid-sized factories. Clothing manufacturers in regions like Yiwu report cancellations of American orders, and some facilities have shuttered entirely. With U.S. buyers now confronted with prices inflated by

over 145%, China’s exporters are watching their most valuable market evaporate.

Electronics and ultra-fast fashion sectors, once buoyed by the de minimis rule that exempted small shipments from tariffs, now face existential threats. Giants like Shein and Temu have been forced to raise prices, and export orders from the U.S. have plummeted by as much as 30% in some manufacturing hubs.

Factory Shutdowns and the Human Toll

The production crisis has rippled across China's coastal provinces. In Guangzhou’s Panyu district, garment factories have ground to a halt. Dongguan’s leather goods sector, heavily reliant on U.S. buyers, has also contracted.

"Workshops have shut down everywhere in just two months," reports a local factory owner.

Many suppliers lack the financial flexibility to relocate operations abroad, making bankruptcy a looming inevitability. With Chinese New Year shutdowns already reducing production in early 2025, the timing of the tariffs created a perfect storm.

Port Paralysis and Global Supply Chain Disarray

China’s key ports—Shanghai and Guangdong—are now eerily still. Container throughput at Shanghai dropped 6.1% and port activity fell 9.7% just a week after the April 9 tariff deadline.

Meanwhile, companies worldwide are shifting to a “China+1” strategy, rerouting trade through Vietnam, India, and Mexico. Shipping costs from Southeast Asia to the U.S. have surged, and intermediate goods trade is being restructured in real time.

The Numbers Behind China's Export Story

Despite escalating tensions, China's exports had shown resilience prior to the 2025 standoff:

The 2024 growth was driven by surging exports of integrated circuits (+21.6%) and automobiles (+18.9%), but that momentum now faces major disruption.

Strategic Tech Battleground

Semiconductors and AI have become central fronts in the U.S.-China trade war. In March 2025, the Trump administration blacklisted over 200 Chinese entities and tightened chip export restrictions, aiming to stifle China’s AI and supercomputing progress. These moves disrupted China’s chip sector, sparking price hikes and layoffs, though U.S. firms outsourcing manufacturing remain shielded from retaliation.

In response, China imposed export bans on gallium, germanium, and antimony—key inputs for semiconductors—while fast-tracking domestic AI development. The AI industry hit 600 billion yuan in 2024 and may exceed 1.7 trillion yuan by 2035. Tech giants like Baidu, Alibaba, and Tencent are advancing large language models, and Beijing is ramping up investment in frontier fields like biomanufacturing, quantum tech, and embodied AI. As decoupling accelerates, supply chains are shifting to Vietnam, India, and Mexico under “China+1” strategies.

Factory Survival Stories

On the ground, factory owners are improvising to survive. In Guangzhou, Ling Meilan, co-owner of a shirt factory, said, “If you can't export, there will be fewer orders, and there will be nothing to do.” She’s now pivoting to China’s domestic market. Nearby exporters have already shut down.

In Beijing, bar owner Mr. Mung is replacing American whiskey with Chinese and European brands. Others, like factory manager Yao, who mainly supplies Amazon, are scouting new markets. Across the Pacific, American small businesses like S&H Auto Repair in Pennsylvania are seeing job cancellations amid rising uncertainty. Gene Seroka of the Port of Los Angeles warns, “One in nine jobs in Southern California... go to work every day with the efforts that emanate from this port.”

A Timeline of Escalation

The escalation of tariffs in 2025 has been swift and severe:

The heaviest impacts have hit U.S. solar, electronics, and agriculture, while Chinese industries are grappling with margin compression and inventory overflow.

Economic Response and Stimulus

China has responded with sweeping fiscal and monetary policies to soften the blow:

Long-Term Shifts and Global Reordering

The trade war has spurred fundamental changes to global supply chains. Mexico, Canada, Vietnam, and India are the top beneficiaries of U.S. trade diversion. Yet, even as manufacturing relocates, much of the upstream supply chain remains rooted in China—suggesting these shifts are more cosmetic than complete.

Meanwhile, China's “Made in China 2025” and Belt and Road initiatives continue to push for economic diversification. The digital yuan is gaining ground in cross-border transactions, and Beijing is investing heavily in energy transition technologies and mineral supply chains.

Looking Ahead: Two Divergent Futures

The world stands at a forked road. In one direction lies continued conflict: the IMF projects global growth of just 2.8% in 2025 and warns of worsening stagnation if tariffs persist. In the other, the potential for détente—Trump has hinted at reductions, and Treasury officials admit current tariff levels are "unsustainable."

Whether this storm will pass or become the new normal depends on diplomacy. Global trade has entered a new, uncertain era.