Ceasefire Sparks Market Repricing: Relief, Rotation, and a Possible Paradigm Shift

Asia led a sharp global equity rally following the Israel–Iran ceasefire, with South Korea and Hong Kong outperforming. The shift reflects more than relief—it signals a deeper rotation into undervalued, high-growth Asian markets.

On June 23, 2025, U.S. President Donald Trump took to Truth Social to announce a “complete and total” ceasefire between Israel and Iran—an unexpected diplomatic climax to what he dubbed “THE 12 DAY WAR.” Hours earlier, Iran had launched missile strikes on a U.S. airbase in Qatar, yet notably refrained from blocking the Strait of Hormuz. Markets interpreted this restraint as a de-escalation signal. The reaction was swift: oil prices collapsed, equity futures surged, and risk assets found renewed demand.

But the ceasefire catalyzed more than just a short-lived relief rally. Beneath the headlines, a deeper rotation was underway—out of the West and into Asia. From reassessed geopolitical risk premiums to recalibrated central bank expectations, the market shift triggered on June 23 may mark a structural turning point in the global financial narrative.

Asia’s Surge: More Than a Ceasefire Rally

While the Israel–Iran ceasefire provided immediate psychological relief to global investors, year-to-date equity performance reveals a broader, more consequential trend: a decisive rotation into Asian equities that predates the Middle East escalation.

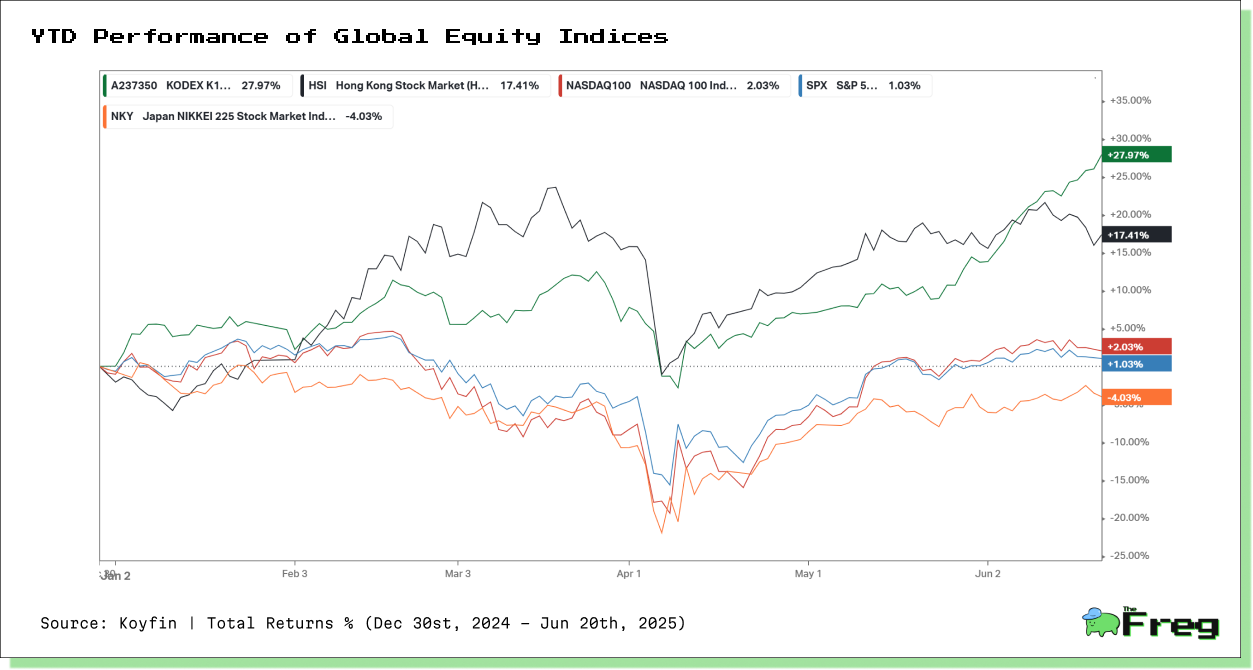

The chart above illustrates just how pronounced this rotation has been:

- South Korea’s KODEX KOSPI 200 ETF (A237350) leads global equity markets with a +27.97% YTD gain, riding the wave of a booming semiconductor sector.

- Hong Kong’s Hang Seng Index (HSI) follows with +17.41%, reflecting renewed confidence in China-adjacent assets.

- In contrast, the NASDAQ 100 (+2.03%), S&P 500 (+1.03%), and Japan’s Nikkei 225 (-4.03%) look increasingly stagnant.

These figures make one thing clear: the ceasefire was not the cause of Asia’s outperformance—it was the accelerant.

Global Equities Rally: Rotation into Risk, Especially in Asia

The ceasefire catalyzed a powerful global relief rally, but Asia didn’t just participate—it led. Investor sentiment turned sharply risk-on, with South Korea’s Kospi at the front of the pack, boosted by semiconductor giants like Samsung Electronics and SK Hynix. These gains reflected more than knee-jerk optimism—they indicated structural repositioning toward regions perceived as both undervalued and geopolitically buffered.

Jack Ablin of Cresset Wealth Advisors noted:

“The ceasefire lifts some of the geopolitical uncertainty surrounding the markets.”

Technology, travel, and tourism stocks gained ground globally, while safe havens like gold and U.S. Treasuries saw diminished appeal.

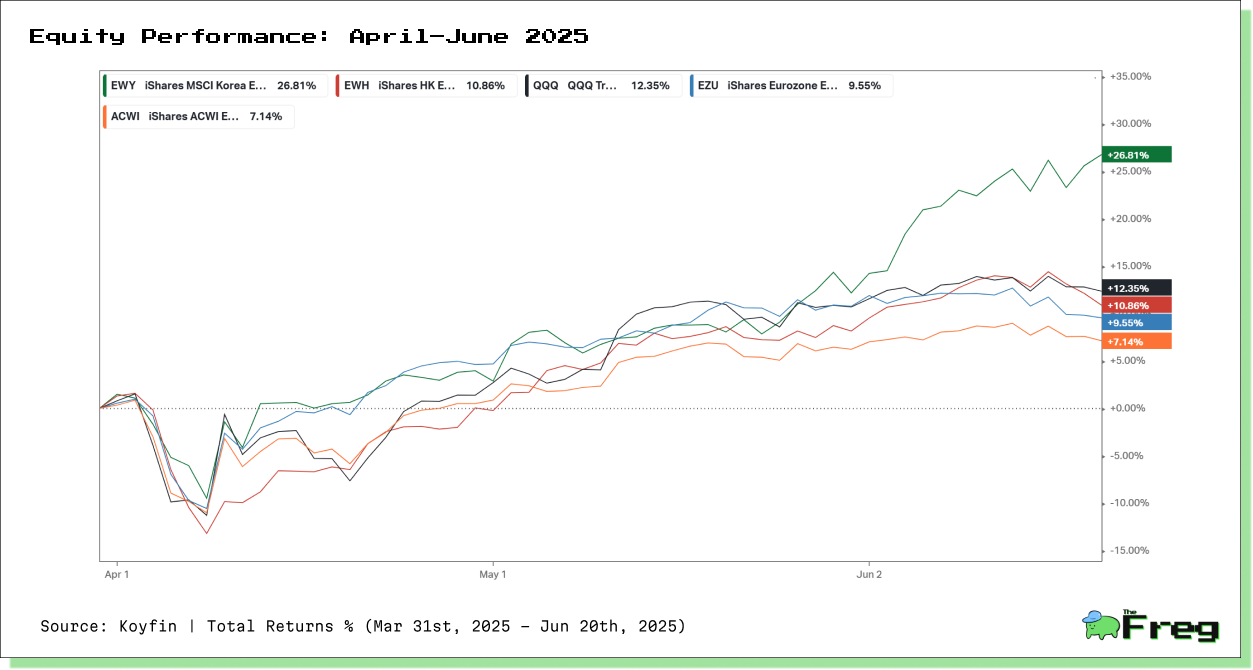

This chart highlights the post-April divergence in global equity performance:

- South Korea’s EWY ETF surged +26.81%, leading all tracked markets.

- Hong Kong’s EWH climbed +10.86%, outpacing both Europe and U.S. tech.

- NASDAQ 100 (QQQ) showed a solid +12.35% gain, yet lagged the Asian surge.

- Meanwhile, iShares ACWI (a global equity proxy) returned just +7.14%, showing how concentrated the momentum shift has been.

The market is increasingly searching for alpha in Asia’s under-owned, high-growth pockets, not in the familiar but overextended Western tech giants.

Regional Drivers: Why Asia Is Pulling Ahead

The outperformance of Asian equities is being driven by region-specific fundamentals—not just the absence of war.

South Korea: AI Infrastructure Powerhouse

South Korea’s nearly 28% YTD rally is powered by the global semiconductor cycle and strong AI-driven demand for computing hardware. The nation’s equity market is no longer just a cyclical trade—it’s emerging as a structural core in the next wave of digital infrastructure.

Hong Kong: A Repricing of Chinese Risk

Hong Kong’s rally reflects receding regulatory overhangs and improving liquidity conditions from the People’s Bank of China. The +17.4% YTD return suggests that investors are warming up to China-linked assets, though cautiously.

Japan: Positive Signals, But Lagging

Despite the Bank of Japan’s hints at policy normalization, Japan’s –4.03% YTD performance underscores persistent concerns: weak global demand for Japanese exports, doubts over inflation sustainability, and policy credibility issues continue to weigh on sentiment.

U.S. and Europe: Defensive but Flat

While U.S. equities have remained resilient, they lack momentum. The S&P 500’s +1.03% and NASDAQ 100’s +2.03% YTD gains reflect defensive positioning amid macro uncertainty, stretched valuations, and political ambiguity ahead of the 2025 U.S. presidential election.

In Europe, performance has been similarly muted. The iShares Eurozone ETF (EZU) is up just +9.55%, trailing both Hong Kong and Korea.

What the Data Really Says

The data paints a clear picture: Asia’s equity leadership is not a post-ceasefire fluke—it’s a broader realignment. Investors are actively rethinking risk in a world of multipolar growth, fragmented supply chains, and asynchronous monetary policy.

Asia now appears less like a satellite and more like a center of gravity in the global investment thesis for 2025.

Conclusion: A Turning Point?

June 23, 2025, may be remembered not just as the day a Middle East war paused—but as the moment a new market regime began. The ceasefire acted as a catalyst, unleashing a repricing across commodities, equities, and currencies.

Investors should remain cautious—ceasefires are not peace treaties—but if early signals hold, we are witnessing the opening chapter of a sustained rotation: one that favours Seoul and Hong Kong over Silicon Valley and Tokyo.