Cautious Tightening: What Japan’s Bond Strategy Says About the World

Japan's BOJ holds rates steady and slows bond tapering, signalling a shift toward geopolitical risk management over traditional inflation goals. As global uncertainty rises, central banks pivot from tightening to caution, prioritizing stability over speed.

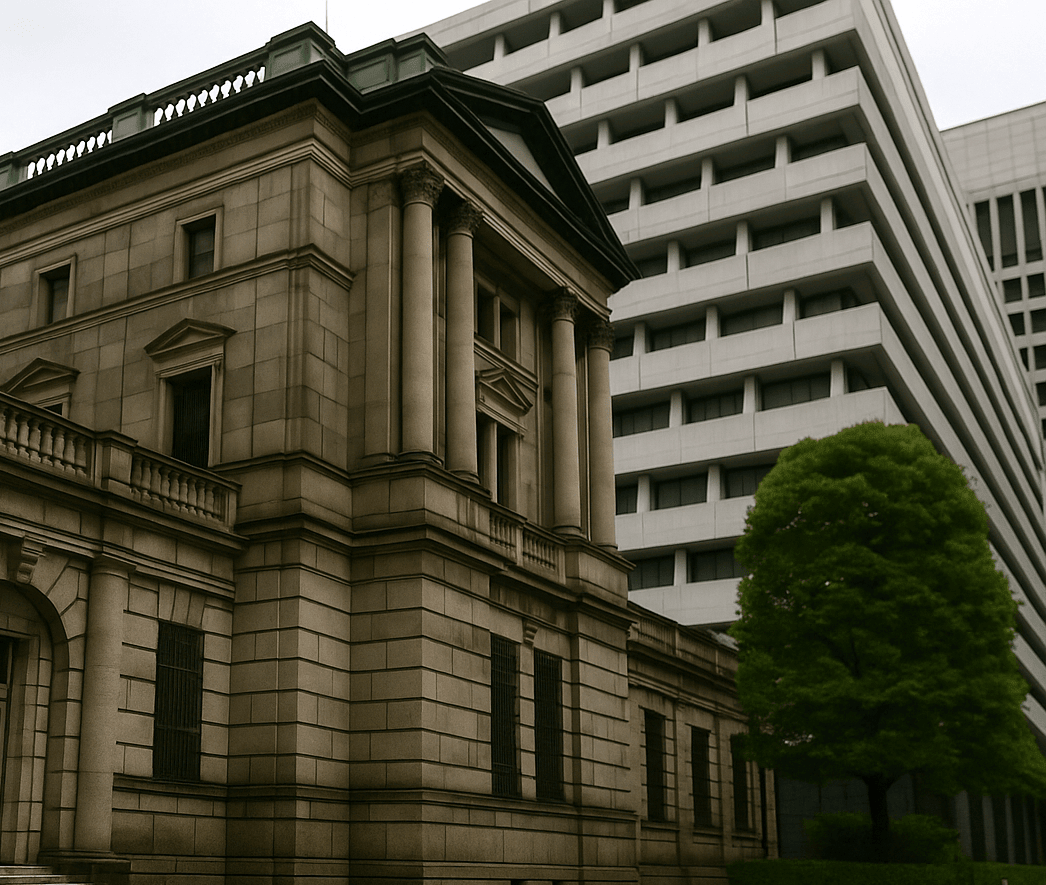

In a move reflecting its cautious recalibration amid growing global uncertainty, the Bank of Japan (BOJ) has kept its short-term interest rate steady at 0.5% for a third consecutive meeting. While Governor Kazuo Ueda reaffirmed the bank’s readiness to raise rates if economic and price conditions improve, the decision highlights Tokyo’s increasingly measured approach to normalization. With inflation above the BOJ’s 2% target and GDP contracting by 0.2% last quarter, Japan faces a complex landscape—compounded by renewed U.S. tariff threats and energy market volatility stemming from geopolitical tensions. The result is a BOJ more focused on stability than speed.

A Global Pivot Toward Caution

The BOJ’s decision to slow the pace of its bond tapering program reflects a broader international trend. Starting in fiscal 2026, the bank will reduce its quarterly bond purchases by ¥200 billion, down from the previously planned ¥400 billion—a shift that mirrors a worldwide move toward monetary conservatism amid renewed economic ambiguity.

Governor Ueda’s dovish tone is echoed across central banks worldwide. With U.S. tariff threats intensifying and trade policy volatility on the rise, the priority has shifted from aggressively taming inflation to maintaining macroeconomic stability. BOJ board member Naoki Nakamura even advocated for a pause in rate hikes, citing direct risks from evolving U.S. trade actions.

These moves underscore a converging outlook among central banks, despite differing economic fundamentals. For Japan, inflation is projected to cool to 1.7% by 2026, but policymakers remain reluctant to accelerate tapering, preferring instead to provide “breathing space” for markets—an acknowledgment that trade geopolitics now weigh as heavily as domestic indicators in monetary calculus.

The Global Reach of Japan’s Bond Market

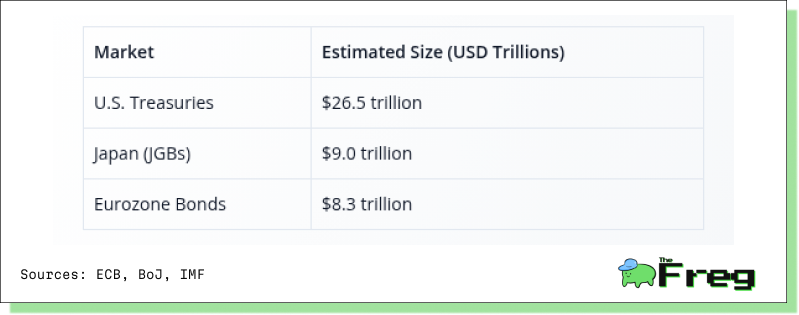

Once a largely domestic affair, Japan’s bond market has emerged as a barometer for global financial conditions. With a total market size second only to U.S. Treasuries—estimated at $9 trillion—Japanese Government Bonds (JGBs) now shape international investor behavior and cross-border capital flows.

The BOJ’s decision to reduce the pace of tapering eases fears of sudden liquidity contractions, particularly as Japanese institutional investors are less likely to repatriate capital en masse from overseas assets. This has offered temporary relief to U.S. and European debt markets already under strain from fiscal deficits and inflationary pressures.

Still, this calculated approach carries risks. Japan’s public debt sits at approximately 250% of GDP, and the BOJ’s balance sheet remains enormous—nearly equivalent to the size of the entire economy. Should global inflation resurge or capital flows reverse sharply, Japan’s delay in normalization could contribute to systemic imbalances, amplifying financial instability worldwide.

Currencies and Confidence

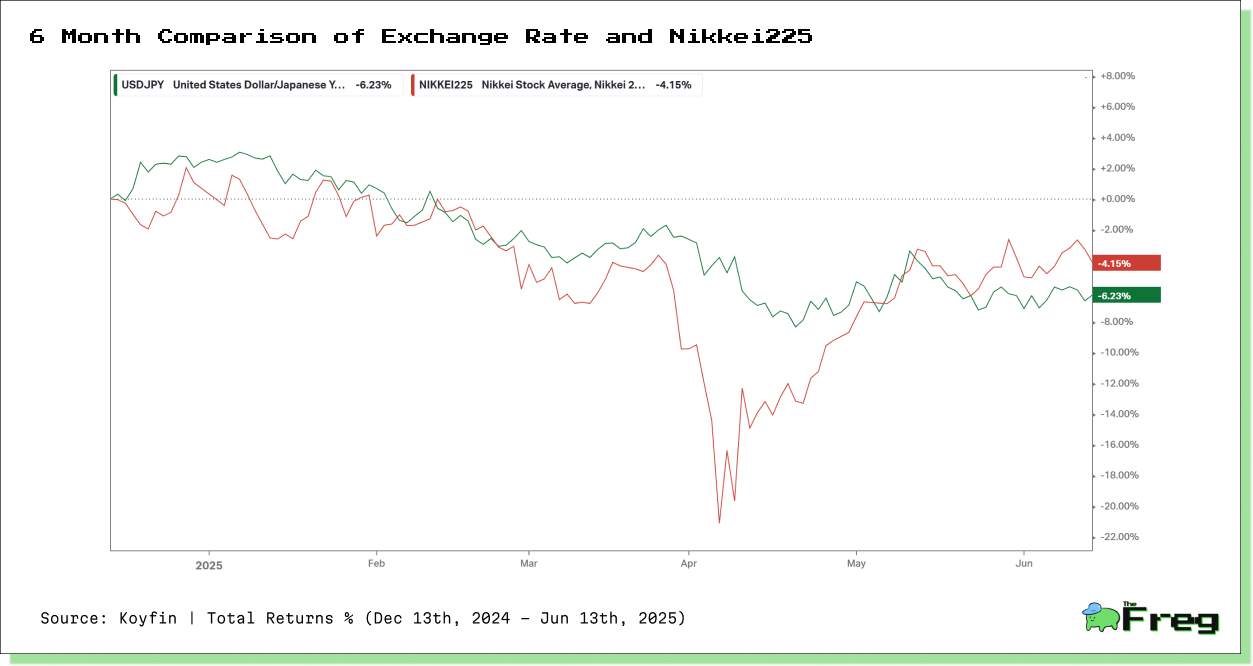

The interplay between Japan’s currency and equity markets in 2025 offers a revealing snapshot of investor sentiment amid the Bank of Japan’s cautious policy stance. As shown in the chart below, both the yen and the Nikkei 225 have declined over the past six months, with the yen weakening by approximately 6.23% against the U.S. dollar and the Nikkei 225 recording a total return loss of 4.15%. This concurrent drop suggests that markets are increasingly unconvinced by the stimulative effect of yen depreciation, especially in the absence of stronger signals around domestic demand or global trade stability.

Notably, during April, the sharp decline in Japanese equities occurred even as the yen continued to weaken—a clear indication that foreign exchange-driven boosts are no longer sufficient to support equity valuations when broader geopolitical and economic anxieties dominate. This breakdown in the traditional inverse relationship highlights how BOJ’s communication and strategy are now evaluated within a more complex global context, where currency moves reflect concern rather than confidence.

Geopolitics as Monetary Catalyst

A defining theme of this policy cycle is the outsized influence of geopolitics. The BOJ’s shift toward cautious tapering and delayed rate normalization is being driven less by inflation or growth metrics and more by the geopolitical landscape—specifically, rising oil prices from Middle East tensions and U.S. tariff threats targeting Asian trade partners.

Governor Ueda acknowledged that trade policy developments have had a “larger impact on Japan’s economy than we had expected.” This sentiment is shared across central banks, where the role of traditional economic models is waning in the face of political uncertainty. Johann Sycamore of IG put it plainly: “To be a central banker right now is one challenging job… the tariff situation and trade policy uncertainty are overshadowing macro fundamentals.”

Japan’s persistently high inflation—hovering around 3.5%—has taken a backseat in policy deliberations as global trade and diplomatic alignments take center stage. The upcoming July 9 U.S. tariff deadline is particularly consequential, threatening to alter the trajectory of Japan’s export-driven recovery and its broader monetary stance.

Central Banks as Crisis Managers

The BOJ’s strategy reveals a larger shift in central bank philosophy. No longer functioning solely as inflation fighters, monetary authorities are increasingly acting as crisis managers. By halving tapering plans and leaving the door open to adjust further via a mid-2026 policy review, the BOJ exemplifies this new role.

This evolving mandate has implications far beyond central banking. Governments are now under pressure to align fiscal and trade policy with monetary tools, blurring once-distinct lines between political and financial governance. For businesses and investors, this era demands a new strategy: one that accommodates prolonged intervention, volatile asset valuations, and unpredictable policy shifts driven as much by diplomacy as by data.

Japan’s monetary strategy, once marked by rigid deflation-fighting orthodoxy, is now emblematic of a global shift toward flexible, politically attuned policymaking. The BOJ’s cautious pace—while a nod to domestic fragility—is also a reflection of the broader geopolitical tremors reshaping central banking itself.

As global interdependence deepens and traditional models lose predictive power, central banks like the BOJ are rewriting their playbooks. Whether this approach succeeds in maintaining stability without inviting new distortions remains to be seen—but for now, the message is clear: in today’s world, monetary policy is no longer just about money. It’s about managing risk in all its forms.