Bull Market, Fragile Foundations: Inside the Crosscurrents of Q2 2025

Despite record highs in Q2 2025, U.S. markets reveal deep contradictions—AI-fuelled tech gains mask bond market warnings, volatility mispricing, and signs of leadership fragility. A rally built on shaky ground may face sharp tests ahead.

The second quarter of 2025 will be remembered not just for new highs in equity indices, but for the deep contradictions they mask. From a historic rally in tech stocks to sharp bond market warnings and a plunging dollar, the U.S. financial landscape today presents a paradox—one defined by optimism on the surface and fragility beneath.

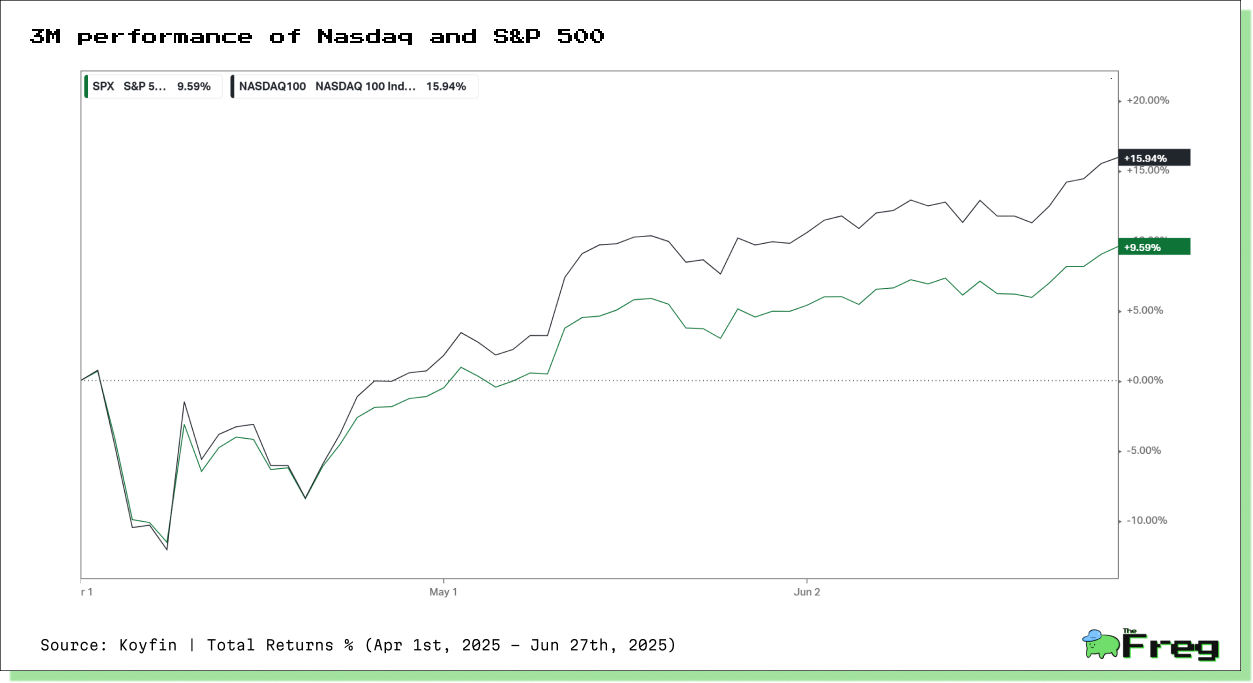

A Historic Quarter for the S&P 500

On June 30, the S&P 500 closed at an all-time high of 6,204.95, capping a dramatic turnaround from April’s tariff-induced turmoil. The index gained 9.59% during Q2, while the Nasdaq surged by a staggering 15.94%, posting its best quarterly performance since June 2020. These milestones came despite what many analysts described as one of the most chaotic quarters in recent memory.

The rally was underpinned by a confluence of developments: Canada’s withdrawal of its digital services tax (a move that benefited major tech firms), optimism following a new U.S.–China trade agreement announced by Donald Trump, and renewed hopes for domestic rate cuts and regulatory easing. As Lisa Shalett, CIO at Morgan Stanley Wealth Management, observed, “Equity investors appear to have entered another ‘bad news is good news’ phase.”

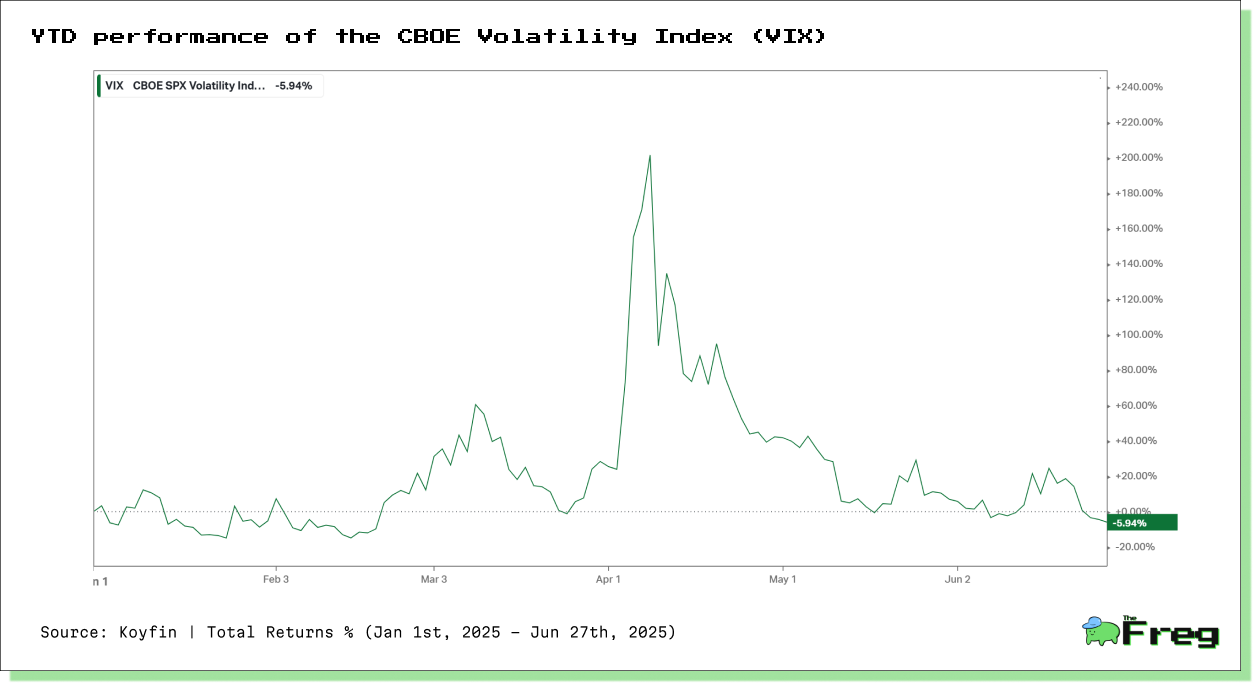

Volatility Collapses in Q2—but the Calm Feels Unnatural

In stark contrast to the sharp swings earlier in the year, Wall Street’s so-called “fear gauge”—the CBOE Volatility Index (VIX)—sank dramatically in Q2 2025. From early April highs, the VIX declined by 25.03% through the end of June, suggesting a swift return to investor complacency even as macroeconomic risks and geopolitical uncertainty persist.

This Q2 retreat follows a highly turbulent start to the year. Year-to-date, the VIX has fallen by approximately 5.94%, but that modest net decline masks an intense spike in early April when tariff fears and an AI-led tech selloff sent the index soaring over 200% before rapidly reverting.

The dramatic volatility spike in early April—while brief—was one of the sharpest in recent memory, rivalling episodes like the February 2018 “Volpocalypse.” However, the swiftness of its collapse has drawn concern. As market strategist Knox Ridley noted, “When volatility compresses this quickly after a macro shock, it doesn’t mean the risks have gone away. It often means they’ve been mispriced.”

The market's apparent calm masks lingering tensions: unresolved trade policy risks, inflation uncertainty, and fragile bond market dynamics. With the VIX now trading well below its historical average, many analysts warn that this low-volatility regime may be more a function of speculative positioning than true risk dissipation.

In short, the VIX's behaviour this year reinforces a broader narrative playing out in financial markets—one of dissonance between surface-level optimism and underlying instability.

Tech Titans Still Rule—But Divergence Is Emerging

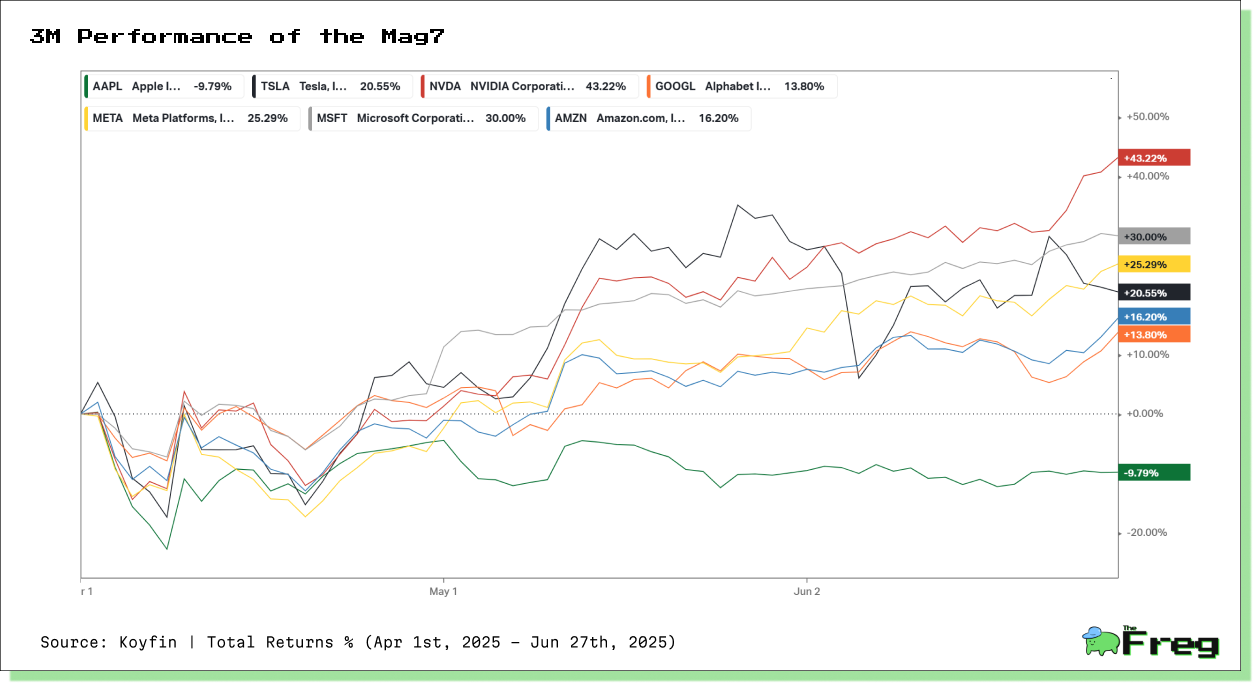

The market’s relentless march higher in Q2 2025 was once again powered by the dominance of the "Magnificent 7"—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. These seven companies continue to punch far above their weight, accounting for over one-third of the S&P 500’s market capitalization and a disproportionate share of total returns. Yet, their performances over the past three months paint a more nuanced picture of leadership that is beginning to splinter.

The standout is Nvidia, up more than 43% in just three months, bolstered by AI infrastructure demand and explosive earnings momentum. Microsoft and Meta also delivered strong double-digit gains, driven by productivity software integration and digital advertising rebound, respectively.

Yet, cracks in the leadership group are now visible. Apple has notably diverged from its peers, declining nearly 10% over the same period. This underperformance reflects concerns around its hardware-heavy revenue model, slowing China sales, and the absence of a clear Gen AI product roadmap.

While the overall group remains powerful, this internal dispersion raises fresh questions about the durability of Big Tech’s market grip. If leadership becomes more fragmented or if one or two giants falter further, the S&P 500—so heavily reliant on their momentum—could face valuation headwinds.

As one market strategist put it: “The concentration is still there, but it’s starting to fracture. And once the perception of invincibility fades, rotations can be sudden and sharp.”

Bond Market: A Stark Contradiction

Even as stocks break records, bond markets are flashing red. Yields remain elevated, with the 10-year Treasury hovering around 4.2%. In April, the yield jumped from 3.86% to 4.5% in five trading days—marking the largest three-day move in 30-year bonds since 1982.

Foreign appetite for U.S. debt has waned, with investors pulling $5.3 billion from BlackRock’s long-term Treasury ETF in a single month. Knox Ridley of IO Fund bluntly put it: “There are no meaningful buyers right now.”

This bond market divergence underscores a critical disconnect: equity markets appear priced for perfection, while fixed income investors prepare for turbulence.

Conclusion: A Market Walking a Tightrope

The current moment in financial markets is one of stark contrast. On the surface: historic highs, AI-led exuberance, and resilient corporate earnings. Beneath: waning bond market confidence, fiscal risks, and a weakening dollar. As equity valuations stretch and earnings expectations run hot, the margin for error has narrowed considerably.

The road ahead will hinge on whether fundamentals catch up with market optimism—or whether the caution signalled by bonds and global capital flows will once again assert itself. For now, markets remain suspended between euphoria and reality—at a precarious, possibly historic, inflection point.