Bitcoin vs Gold: The ETF Faceoff That Redefines the Store-of-Value Debate

Bitcoin has delivered stronger long-term growth than gold but comes with much higher volatility. While gold offers stability during market stress, bitcoin’s potential for higher returns appeals to those with a higher risk appetite.

The enduring philosophical debate between Bitcoin and gold is taking a new turn in financial markets. What was once a battle of ideologies—digital scarcity versus millennia-old permanence—is now being formalized through innovative ETFs. Tidal Financial Group’s proposed Battleshares ETFs offer investors the chance to bet directly on which of the two assets will outperform in times of macroeconomic turmoil. This marks a decisive moment, transforming a long-standing cultural divide into a tangible financial product.

Ancient vs. Digital: Competing Philosophies

Gold, humanity’s oldest store of value, has endured for over 5,000 years. It represents stability, physical tangibility, and universal recognition. Bitcoin, born out of the 2008 financial crisis, emerged as a decentralized digital asset with a finite supply of 21 million coins. This scarcity is enforced through cryptographic algorithms, appealing to those disillusioned with fiat currencies and central banking.

While both assets are decentralized, globally recognized, and inflation-resistant, they diverge in practicality. Gold offers trust and physical security; Bitcoin offers divisibility, portability, and verifiability. The debate, ultimately, is about two competing visions for the future of money.

Safe Havens in Times of Crisis

Historically, gold’s safe haven status has been proven through multiple crises—the 1970s oil shock, the Iran hostage crisis, and the 2008 financial meltdown. Bitcoin’s resilience was tested during the COVID-19 crash when it plunged 50% in a single day before bouncing back 300%—a dramatic testament to its volatility and potential.

Ray Dalio, founder of Bridgewater Associates, underscores this evolution. While he prefers gold, he’s also warmed up to Bitcoin, stating the need for “some hard money like gold and bitcoin” in portfolios. Though Bitcoin lacks the long-term track record of gold, it shares the Lindy effect in its own digital way: the longer it survives, the more likely it is to remain.

ETF Innovation: A New Arena for the Old Duel

Tidal Financial’s Battleshares ETFs, still awaiting approval, are designed to capitalize on the relative performance between Bitcoin and gold using instruments like short selling, swaps, and options. These ETFs represent more than financial novelty—they allow investors to place directional bets on macroeconomic sentiment. Want to express confidence in digital transformation? Go long Bitcoin and short gold. Expecting geopolitical instability? Flip the trade.

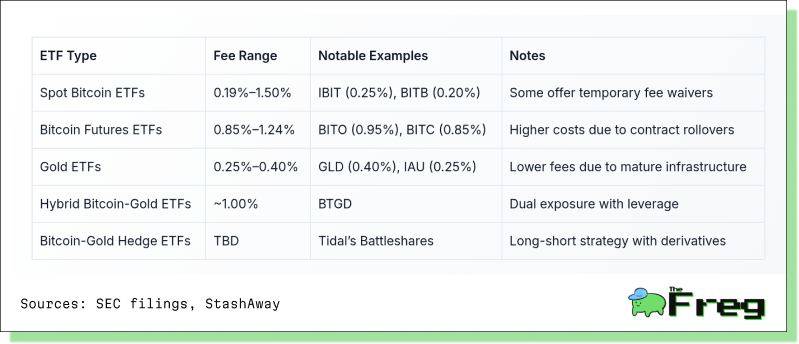

While traditional ETFs like BlackRock’s IBIT (Bitcoin, 0.25% fee) or State Street’s GLD (Gold, 0.40% fee) offer simple asset exposure, Battleshares introduces a tactical alternative. Yet critics like Spectra FX’s Brent Donnelly argue the niche may be too narrow, since many investors bullish on Bitcoin are equally bullish on gold.

Institutional Behavior: Momentum Shifts

Institutional capital is reshaping the battlefront. Bitcoin ETFs amassed $108–134 billion in assets by late 2024, a 950% year-on-year increase. Over 1,900 institutional strategies now include Bitcoin exposure, and major firms like Bank of America, Wells Fargo, and Charles Schwab offer these ETFs to clients.

Institutional Trends in Crypto ETFs (2025)

Following the U.S. SEC's landmark approval of spot Bitcoin ETFs in January 2024, Europe’s dominance in crypto ETPs shrank from 50% to 12.8%. Meanwhile, BlackRock alone holds 580,430 BTC as of April 2025.

Global Regulatory Landscape

Jurisdictions worldwide are evolving to meet demand:

- United States: Spot Bitcoin ETFs approved (2024), Ethereum ETFs followed in July.

- Canada: First to approve Bitcoin ETFs in 2021.

- Germany: Allows funds to allocate up to 20% to crypto; tax-free if held for one year.

This regulatory clarity is boosting Bitcoin’s ETF legitimacy and creating new competition for gold.

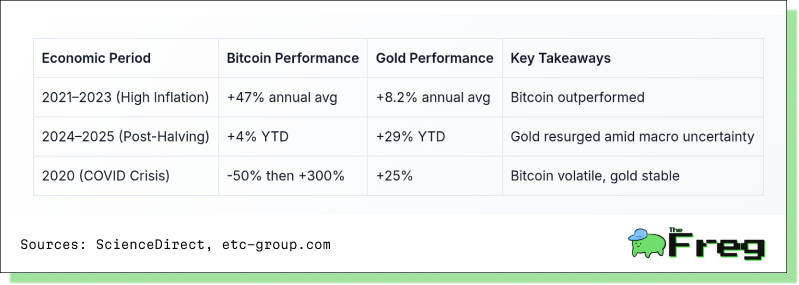

Volatility vs Returns: A Risk-Reward Matrix

Bitcoin has outperformed gold by a wide margin in long-term returns but at the cost of greater volatility. Its 10-year CAGR stands at roughly 47%, compared to gold’s modest 6.8%. Yet Sharpe ratios—risk-adjusted return measures—are surprisingly competitive:

Their correlation has also risen sharply—reaching 0.87 in early 2024—suggesting investors are beginning to see both assets as complementary hedges.

Inflation Performance: Who Hedged Better?

Bitcoin’s supply inflation rate is now below gold’s for the first time—a historic shift in digital scarcity dynamics.

Comparative Fee Structures

The Verdict: Competition or Coexistence?

Rather than displacing gold, Bitcoin may simply join it. Bernstein analysts forecast Bitcoin as the “leading store of value of the modern era,” but institutional portfolios are increasingly constructed with both assets in mind.

Younger investors favor Bitcoin for its growth and digital nature, while gold retains its appeal among conservative allocators. The launch of ETFs like BTGD, which gives 100% exposure to both assets through leverage, symbolizes a shift from rivalry to coexistence.

In a world facing inflation, geopolitical strife, and financial system skepticism, the answer may not be gold or Bitcoin—but both.