Bitcoin at $123K: A Market Transformed or Just Another Peak?

Bitcoin’s surge to $123K in 2025 marks a shift from hype to legitimacy, driven by institutional inflows, regulatory clarity, and macroeconomic tailwinds reshaping global finance.

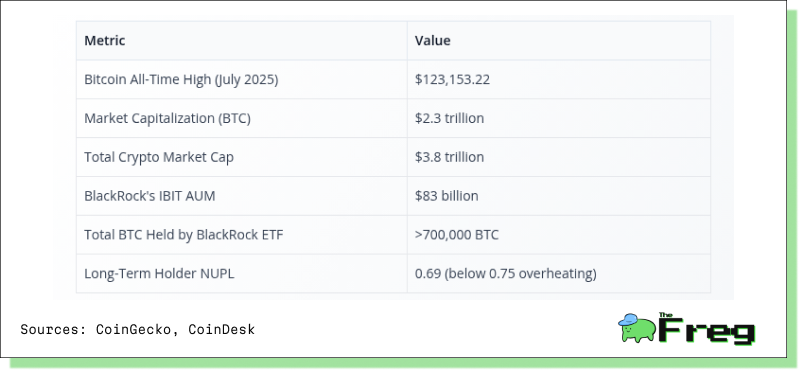

On July 14, 2025, Bitcoin hit an unprecedented all-time high of $123,153.22, shattering previous records and pushing the broader cryptocurrency market to a total valuation of nearly $3.8 trillion. Unlike the speculative frenzies of 2017 and 2021, this rally is marked by foundational shifts in how global institutions, governments, and investors engage with digital assets. The timing is symbolic: it coincides with a major U.S. legislative push to establish comprehensive cryptocurrency regulations—efforts backed by President Donald Trump, now increasingly referred to as the “crypto president.”

This ascent signals more than just investor exuberance; it could reflect the growing permanence of cryptocurrency in the global financial ecosystem.

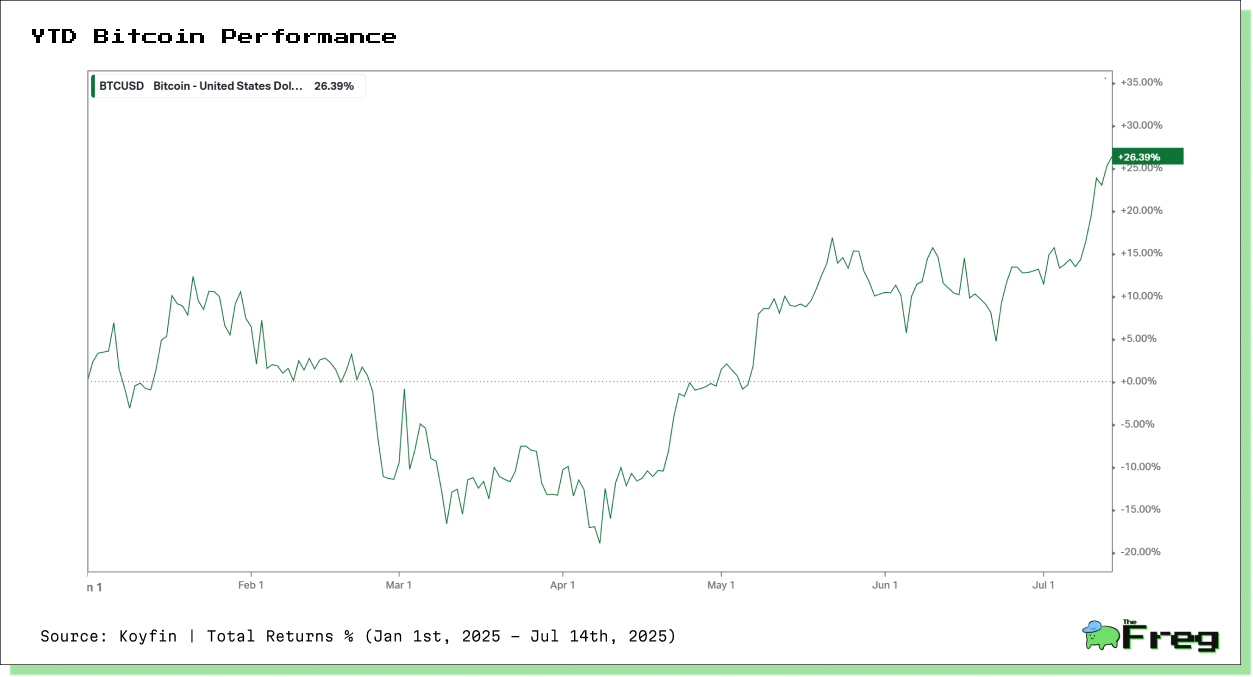

Bitcoin’s 2025 YTD Journey: Volatility, Resilience, and Repricing

Bitcoin’s record-breaking rally to $123,153.22 on July 14, 2025, wasn’t a straight path upward. As the chart below reveals, the cryptocurrency experienced notable volatility in the first quarter, with sharp drawdowns through March, followed by a robust recovery and consolidation in Q2. Year-to-date, Bitcoin is up +18.19%, a return that, while impressive, underscores the asset’s persistent volatility—even in a maturing market environment.

Key Observations:

- Q1 Weakness: Bitcoin saw steep drawdowns in February and March, coinciding with concerns around U.S. rate hikes and slow ETF approvals in Asia.

- Post-April Recovery: Momentum sharply reversed in late April, driven by ETF inflows, bullish regulation headlines, and institutional accumulation.

- Q2 Rally Base: From early May, Bitcoin entered a consistent uptrend with elevated inflows and growing strategic reserve narratives.

Bitcoin vs. Equities: A 2025 Performance Showdown

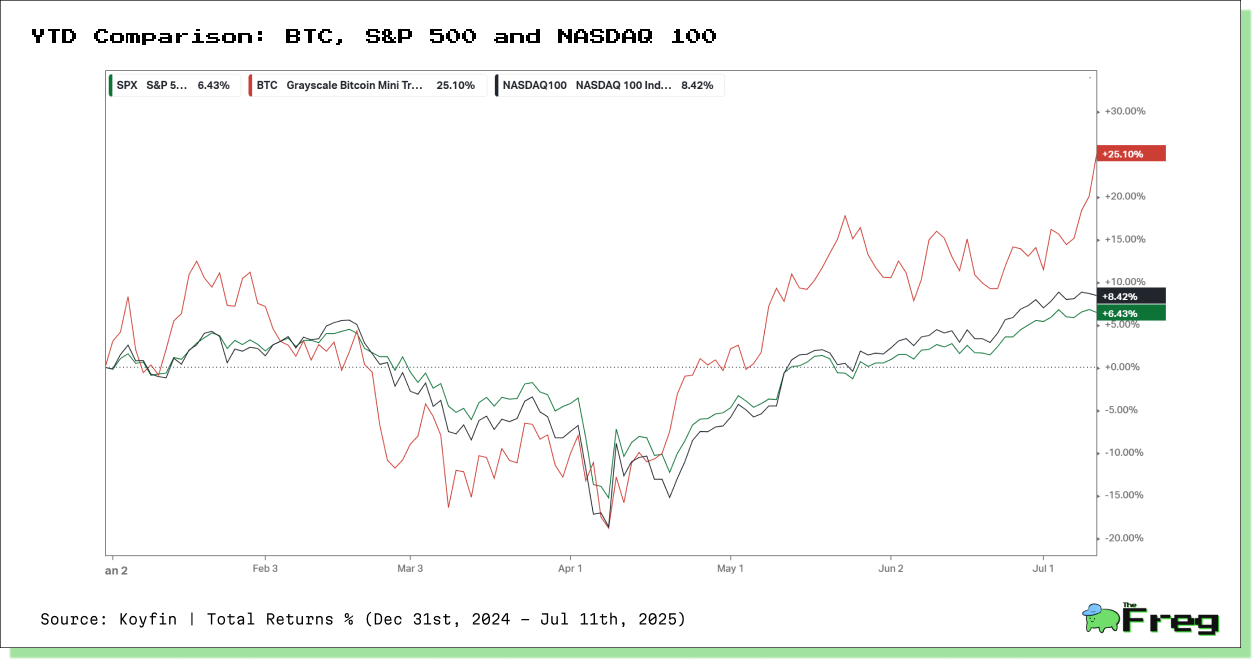

Bitcoin’s 2025 rally has outpaced traditional equity benchmarks, offering a striking contrast to more conventional asset classes. The chart below illustrates total return performance from January 2 to July 14, 2025, comparing:

- Grayscale Bitcoin Mini Trust (BTC) – +18.39%

- NASDAQ 100 Index – +8.82%

- S&P 500 Index – +6.49%

Key Takeaways:

- Volatility Advantage: Bitcoin displayed greater short-term volatility but ultimately outperformed both indices, especially following a sharp rebound post-April.

- Correlation Divergence: During Q1 downturns, all three assets fell in tandem—suggesting correlated risk-off behaviour. But Bitcoin rebounded more sharply, bolstered by ETF inflows and regulatory optimism.

- Risk-Adjusted Returns?: While BTC's return is highest, investors must weigh it against greater volatility and shorter drawdown cycles. Still, the YTD spread over the NASDAQ (nearly +10%) makes the risk-return conversation increasingly favourable.

What’s Powering the Rally?

Bitcoin’s surge past $123,000 is underpinned by unprecedented institutional inflows, signalling a seismic shift from retail speculation to long-term, institutional conviction. BlackRock’s spot Bitcoin ETF (IBIT) has amassed over 700,000 BTC, with $83 billion in assets under management (AUM)—making it the fastest-growing ETF in history.

Last week alone, spot Bitcoin ETFs witnessed a record $1.18 billion in single-day inflows, as institutions sought to hedge against mounting macroeconomic risks.

A Perfect Storm of Fundamentals

This rally differs from past cycles due to several interlocking factors:

- Macroeconomic Hedging: A projected $7 trillion U.S. federal deficit and a $5 trillion debt ceiling increase have turned Bitcoin into a hedge against fiat dilution.

- Regulatory Clarity: Upcoming U.S. legislation—namely the GENIUS Act and CLARITY Act—is reducing ambiguity, opening the gates for cautious institutional capital.

- Technical Maturity: On-chain data shows rising accumulation by long-term holders. Bitcoin’s breakout past its upper Bollinger Band of $120,254 confirms strong momentum.

- Structural Adoption: As XBTO’s George Mandres puts it, Bitcoin is “no longer speculative hype, but a macro reserve asset.”

Asia’s Quiet Crypto Revolution

While the U.S. dominates headlines with over $151 billion in Bitcoin ETF AUM, Asia is stealthily transforming into a major force in the crypto space. Hong Kong, in particular, has emerged as a regional hub since launching Asia’s first spot Bitcoin ETFs in April 2024.

Though initially modest—with $403 million in ETF assets by end-2024—the market has since surpassed HKD$2 billion (~$256 million) in early 2025. As Bitcoin pushed beyond $123,000, ETFs from China AMC, Bosera, and Harvest reached new highs.

Beyond ETFs, crypto-related equities in Asia are booming. Sinohope Technology Holdings, formerly Huobi Technology, surged 26% in a single day during Bitcoin’s February rally.

Regulatory support plays a crucial role. Hong Kong’s Securities and Futures Commission has embraced a proactive, transparent framework, inviting both retail and institutional flows and positioning the city as a crypto-friendly financial hub.

Are We Witnessing a Financial Transformation?

Bitcoin’s $123K milestone isn’t just a chart-topping moment—it may be the beginning of a financial reconfiguration. In 2025 alone, institutional holdings have exploded, regulations are moving swiftly, and sovereign interest is growing—even if central banks remain cautious.

The convergence of:

- Regulatory momentum (GENIUS & CLARITY Acts),

- Technical progress (e.g., BIP-119, Bitcoin Hyper),

- Institutional commitment ($150B+ in ETF assets), and

- Regional growth (Asia’s rise in ETF adoption)

suggests a future where digital assets are no longer peripheral, but central to how capital is stored and grown.

The Road Ahead

Sceptics point to possible short-term corrections—especially near psychological resistance levels. Yet the broader trajectory suggests Bitcoin is increasingly integrated with the traditional financial system. Future developments to watch:

- Final outcomes of U.S. Congressional debates on crypto legislation

- Expansion of crypto ETFs across Asia and potentially Europe

- Whether any central banks begin allocating to digital assets

- Continued inflows into Bitcoin-exposed equities and pension funds

A New Era or Another Peak?

Bitcoin at $123K may be remembered not just as a price point, but as a paradigm shift. This time, it's not retail euphoria or social media hype—it’s about institutional legitimacy, sovereign strategy, and macroeconomic realism. Whether this marks the dawn of Bitcoin’s full financial integration or another high before volatility sets in again, one thing is certain: the crypto conversation is no longer fringe. It’s global, mainstream, and irreversible.