Asia at the Crossroads: Trade Shocks, Capital Shifts, and the Rise of a New Investment Order

Asia stands at the heart of a global economic shift. Amid U.S.–China trade tensions, capital inflows, and supply chain realignment, the region is navigating volatility with resilience—emerging as a key driver of the new global order.

The global economic order is being redrawn—and Asia is at the epicentre. From the intensifying U.S.–China trade confrontation to a surging influx of foreign capital, the region is navigating a profound realignment. Recent shocks have tested resilience, yet also opened doors to transformation—redefining trade relationships, investment flows, and monetary strategies across emerging and developed Asian economies.

The U.S.–China Trade Rift: Turmoil Meets Opportunity

In April 2025, U.S.–China trade tensions escalated to unprecedented levels. The Trump administration imposed tariffs reaching 104% on Chinese imports. China swiftly retaliated with 125% duties on U.S. goods. The result: trade between the two largest economies all but froze, jolting global supply chains and rattling investor confidence.

But amid the dislocation, opportunities emerged for others. Countries less tethered to the volatility of Sino-American trade—like India, Indonesia, and the Philippines—have exhibited relative economic resilience. Talks in Geneva have sparked some optimism, with both sides citing “meaningful progress,” helping restore calm in regional markets.

Key Trends:

- Supply Chain Diversification: China has redirected trade toward ASEAN and Latin America.

- Investor Sentiment: Stock indices in Japan, Korea, and China rebounded on tariff relief hopes.

Dollar Weakness: Fuelling Asia’s Capital Surge

The weakening U.S. dollar, now at a three-year low against major currencies, has been a windfall for Asian economies. As the Fed eyes cuts of 92 basis points over the next six months, Asian central banks have found room for their own rate reductions—albeit shallower.

This currency dynamic is especially pronounced in the appreciation of the Swiss franc (10-year high) and the euro (strongest since November 2021). However, the Asia trade-weighted dollar index fell just 1%, compared to an 8% drop in the DXY, showing Asia's nuanced currency response.

The favourable currency environment is unlocking returns in Asian equities and bonds, with domestic-focused companies benefiting from stronger currencies and reduced import costs.

Asian Markets Rebound: Relief or Real Shift?

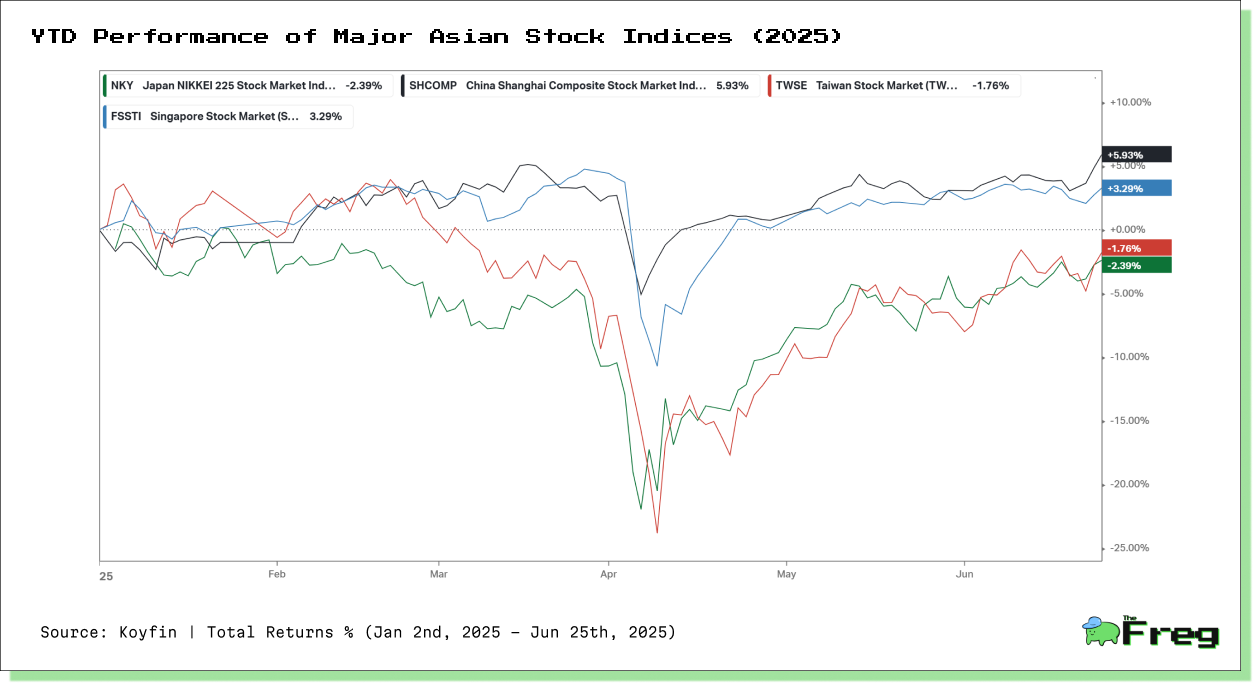

After the April 2025 market meltdown—infamously dubbed "Tariff Tuesday"—Asian equities have roared back. The MSCI Asia Index has surged 25%, reaching a four-year high.

The graph underscores the uneven recovery across major Asian stock markets following the April 2025 trade-driven selloff. While China’s Shanghai Composite (+5.93%) and Singapore’s FSSTI (+3.29%) have climbed into positive territory, supported by easing trade tensions and domestic resilience, markets like Japan’s Nikkei (-2.39%) and Taiwan’s TWSE (-1.76%) remain in the red. The divergence reflects differing levels of exposure to U.S.–China trade risks, currency fluctuations, and policy responses—reinforcing that Asia’s rebound, though broad, is far from uniform.

Fundamentals and Fragilities: Gauging Sustainability

Despite rich valuations in some segments, several domestic factors support Asia’s ongoing market momentum:

- Good monsoon forecasts in India could boost rural demand.

- Government capex is ramping up across India, Indonesia, and Thailand.

- Manufacturing upgrades—especially in EVs and machinery—are propelling corporate earnings.

At the same time, inflation remains subdued, aided by softer oil prices and stronger local currencies, giving central banks ample space to ease.

But vulnerability persists. Vietnam, highly exposed to U.S. export markets, faces outsized risks if tariffs remain unpredictable.

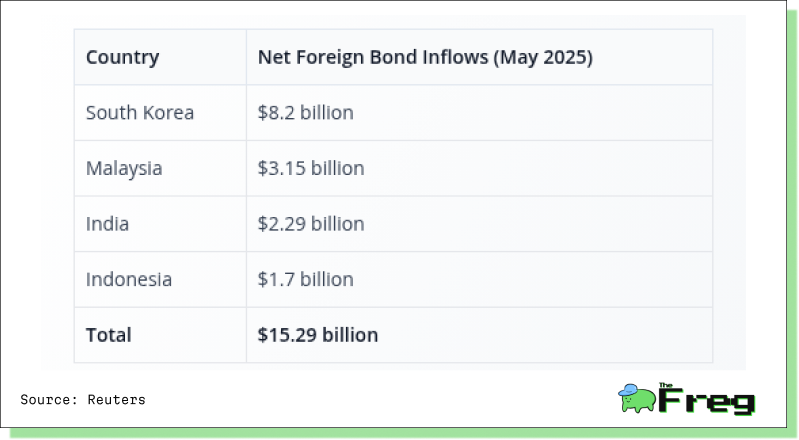

The Bond Boom: Inflows Hit Decade Highs

Asian bonds are enjoying a renaissance. In May 2025, foreign capital inflows reached $15.29 billion, the highest in nearly 10 years.

This surge reflects growing investor confidence in the region's policy stability, currency potential, and yield premiums. As Eastspring Investments describes it: Asia is offering “dynamic exploitable bond opportunities.”

Asia’s Long Game: Cycles and Structures Collide

The current rally may appear cyclical, but underneath lies a deeper structural transformation:

Structural Drivers to Watch:

- Fed rate path and dollar volatility

- U.S. elections’ impact on global trade norms

- China’s internal recovery and FDI pivot

- Wealth inequality and ESG readiness

Asia is not without challenges—but its growing financial autonomy, reform-driven resilience, and demographic heft position it as the global economy’s next growth fulcrum.

The Quiet Reordering

Asia is not simply recovering from shocks—it is reconfiguring itself for a multipolar investment future. The capital inflows, market rebounds, and supply chain shifts unfolding today are not blips—they are signposts of structural change.

As trade fragmentation becomes the norm and Western economies grow more cautious, Asia may be writing its own rules for prosperity. Whether it can sustain the momentum will depend on policy clarity, macro discipline, and the ability to translate investor confidence into inclusive growth.

The world is watching. And increasingly, investing.