Apple’s Great Supply Chain Migration: India Rises, China Retreats, and the U.S. Watches

Apple is rapidly shifting iPhone production to India, reducing reliance on China amid rising geopolitical risks. With U.S. reshoring impractical, India is emerging as Apple’s key hub—though not without infrastructure and political hurdles.

Apple has emerged as the most visible symbol of a global tech industry in flux. What began as cautious diversification has now become a sweeping realignment of its manufacturing network. India is the new nerve centre, China is being steadily side-lined, and the United States remains a vocal but largely side-lined observer of this transition.

The iPhone’s New Passport: Made in India

Between March and May 2025, Foxconn exported $3.2 billion worth of iPhones from India—a staggering 97% bound for the U.S., up from just over 50% in 2024. In March alone, Apple chartered planes to fly iPhones worth $2 billion directly to the American market.

Tata Electronics has followed suit. In March and April 2025, 86% of its iPhone shipments went to the U.S., up from 52% a year earlier. Apple CEO Tim Cook reinforced the trend, declaring that the majority of iPhones sold in the U.S. this quarter would be India-made.

Customs data underscores the scale and speed of this pivot:

In one year, Foxconn's export share to the U.S. jumped from an average of 47% in late 2024 to over 96% by May 2025. India has clearly moved from backup to frontline in Apple’s global supply chain.

Fragile Wins: The Risks in India’s Ascent

India's ascent isn't without friction. Customs delays, high tariffs (some up to 300%), and infrastructure bottlenecks remain. While clearance times at Chennai airport have improved significantly, unpredictability in duties and fees continues to complicate logistics.

Political volatility adds another layer of risk. Trump’s recent remark—"We are not interested in you building in India... We want you to build here"—reflects growing U.S. frustration. With India’s 2029 elections looming, border tensions with China, and tighter U.S. scrutiny of Chinese components, Apple’s pivot remains a calculated gamble.

Why the U.S. Can’t Bring It All Home

Domestic iPhone production remains economically impractical. Labour costs alone would hit $200 per unit in the U.S., compared to just $40 in China. Indian assembly workers earn about $290/month versus $2,900/month in the U.S. Apple estimates this would triple retail prices, pushing a $1,000 iPhone to $3,000.

Tim Cook stresses that China’s edge lies not in wages, but in its deep base of tooling engineers—a skillset largely lost in the U.S. Additionally, China’s ports and logistics network are far superior, hosting 7 of the world’s 10 largest ports.

The Component Bottleneck

Despite robust assembly operations, India remains reliant on imported components—70% in some cases. Basic parts like chargers and battery packs are made locally, but high-value items like semiconductors, displays, and lenses still come from China, South Korea, and Japan.

Apple and its partners are investing through India’s Production Linked Incentive (PLI) scheme. Micron is expected to begin local chip production in 2025/26, but India still lacks East Asia’s semiconductor depth. Apple plans to support 500,000 local jobs via suppliers over three years, though supply chain sovereignty is still distant.

Strategic Forecast: Apple’s Manufacturing Future

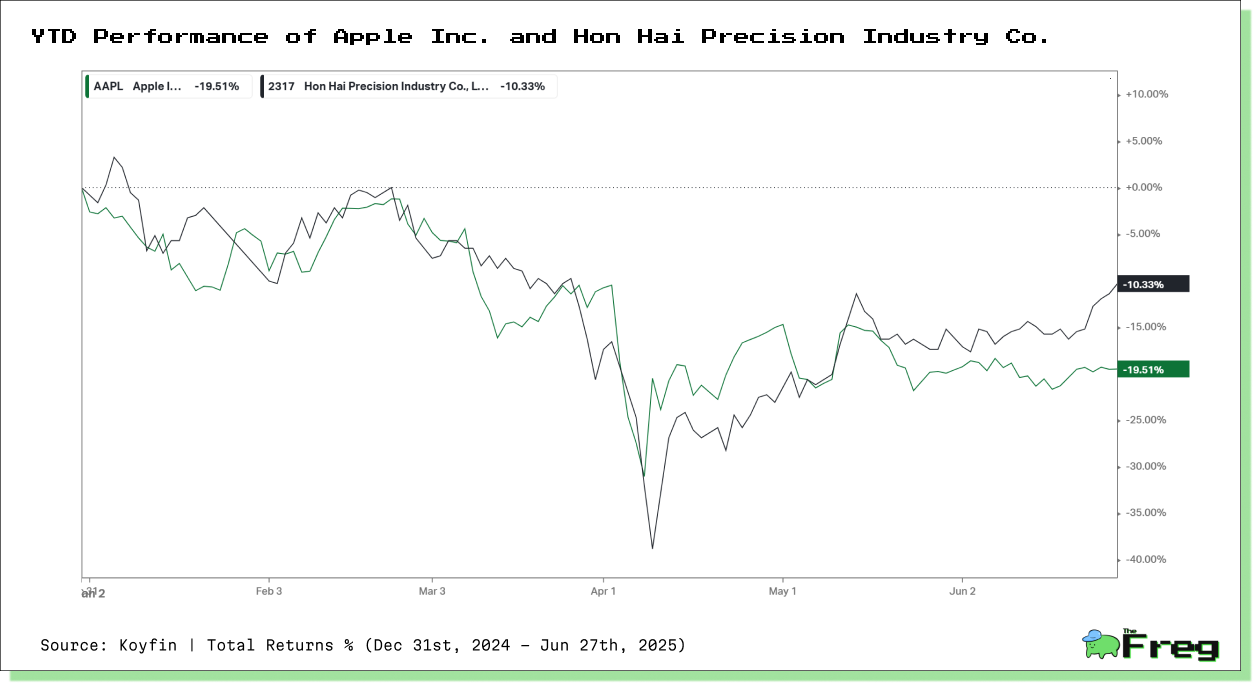

Apple’s pivot reflects a philosophical shift: resilience over efficiency. India-based production costs 5–10% more than China’s, and quality control remains a concern. Yet, Apple is pressing ahead. Suppliers have committed $16 billion to build capacity outside China. Investors remain wary. Year-to-date, Apple shares have dropped 19.51%, compared to Foxconn’s 10.33% decline.

The chart above reflects market scepticism. While Foxconn benefits from a broader client base, Apple bears the brunt of cost inflation and political crossfire. Markets appear to be pricing in a near-term profitability squeeze despite Apple’s long-term strategy.

Possible Futures

- India Solidifies Its Role: If India develops a robust component ecosystem, it could emerge as Apple’s main hub.

- Geopolitical Disruptions: Policy shifts in the U.S. or India could derail the strategy.

- Partial U.S. Reshoring: Government incentives might bring some operations back to America, though large-scale production remains unlikely.

Conclusion: A New Global Production Order

Apple’s supply chain overhaul is more than a reaction to tariffs—it’s a strategic recalibration. India’s rise, China’s retreat, and the U.S.’s stalled ambitions mirror a broader transition in global manufacturing priorities. As Apple redraws its operational map, the smartphone becomes a microcosm of a world rebalanced by politics as much as profit.