AI’s Trillion-Dollar Takeover: Data, and the Dawn of a New Operating System

AI is becoming the new global operating system, reshaping industries, economies, and jobs. With trillions at stake, countries and companies are racing to scale, adapt, and lead in this transformative tech revolution.

At Dell Technologies World 2025, Michael Dell offered a glimpse into the future—and it’s powered by artificial intelligence. “AI is the operating system that will power the world forward,” he declared, projecting that AI could add a staggering $15 trillion to the global economy by 2030.

What was once Silicon Valley’s moonshot has now become a global imperative. Dell predicts global AI investments will exceed $1 trillion, calling it “a well-justified investment” in a world where the knowledge economy already contributes to more than half of global GDP. His company is already walking the talk: 3,000+ AI factories deployed across enterprises, generating 20–40% productivity gains.

AI is no longer on the horizon. It’s here—and moving at what Dell calls “mach three” speed.

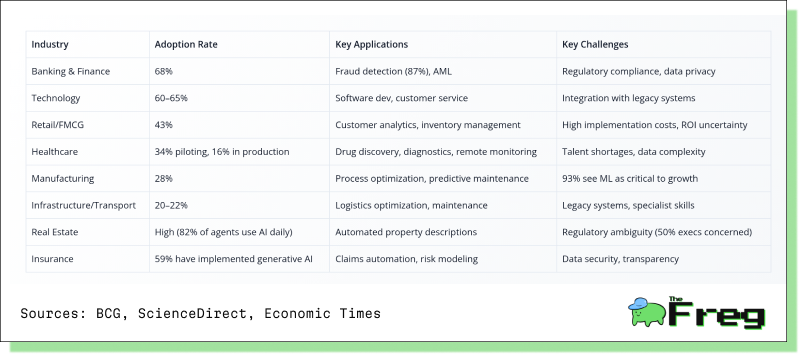

AI Adoption by Sector: Who’s Leading, Who’s Catching Up?

From medicine to manufacturing, artificial intelligence is weaving itself into the fabric of global industry. But adoption remains uneven, both by sector and geography.

Despite promising use cases, only 26% of organizations have developed the capabilities to scale AI beyond pilot phases. Geographic disparities persist as well. India and China lead with implementation rates near 60%, while South Korea (22%), Australia (24%), and even the United States (25%) lag behind.

AI as the New Operating System

When Dell calls AI the “new OS,” he’s not talking about a software upgrade. He’s pointing to a complete redesign of the digital experience—one where AI doesn’t just assist systems, but runs them.

Forget apps. Think conversational, task-oriented computing that predicts your next move. Dell’s upcoming Pro Max Plus laptop is a case in point: 32 onboard AI cores supporting 100-billion-parameter language models locally. It’s not just cutting cloud costs—it’s cutting the cord altogether, offering up to 75% lower total cost of ownership.

Dell’s vision suggests that by 2025, AI will become as common in PCs as SSDs and GPUs are today.

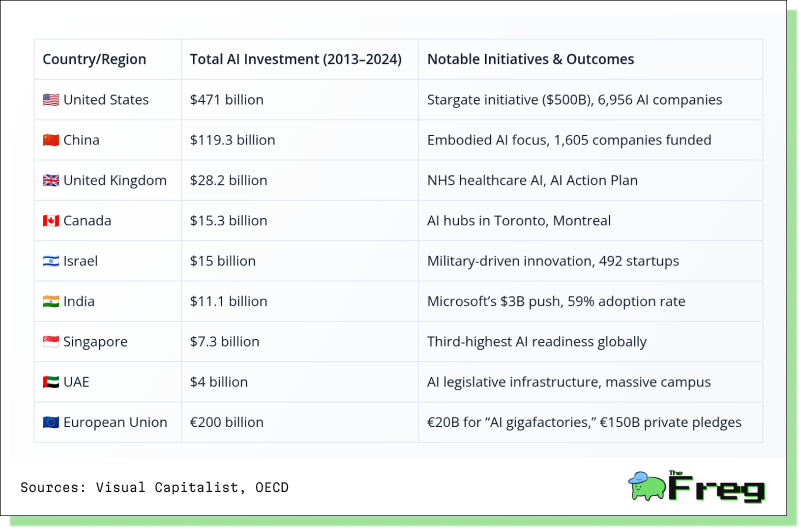

The Global AI Investment Race

Since 2013, the world has funneled nearly $800 billion into private AI funding, with the United States commanding the lion’s share.

Much of this capital is aimed at building the AI backbone—massive cloud and semiconductor infrastructure. Companies like Google ($75B), Amazon, and Nvidia are shaping the terrain.

Where the Money Flows: Infrastructure Is King

In fact, AI infrastructure is now viewed as a distinct asset class, akin to real estate or utilities—a bet on the digital future of everything from healthcare to defense.

Economic Forecasts: $15.7 Trillion… or Just $4 Trillion?

While Dell and PwC foresee AI adding $15.7 trillion to global GDP by 2030, McKinsey provides a more tempered forecast: $2.6–4.4 trillion annually from generative AI across 63 use cases. Even the lower estimate makes AI one of the most transformative economic forces in modern history.

The boost will come from two fronts:

- $6.6T from productivity improvements

- $9.1T from consumption-driven gains

Yet, barriers remain—particularly around regulation, bias, and readiness. Only 26% of companies have reached the stage where AI is driving measurable value.

Job Market: Disruption and Creation

The workforce won’t be spared. The World Economic Forum predicts AI will displace 75 million jobs by 2025—but also create 133 million new ones.

Roles in IT and finance will be most disrupted, while sectors like healthcare, education, and creative industries are expected to grow. The transition will demand sweeping policy responses, especially around upskilling.

Policy Playbooks: Nations Chart Their AI Futures

Governments are crafting vastly different strategies to navigate the AI revolution.

The key divide? Nations like the US and Singapore invest in broad upskilling, while others like China and Germany focus on elite innovation hubs.

AI Market Leaders: The Companies to Watch

Market leaders are cashing in on the AI gold rush:

- Nvidia: 120% YTD growth, Q3 revenue at $35.1B, supplying chips to Google, Meta.

- AMD: Q4 revenue up 24%, strong performance in data centers.

- Palantir: Q3 revenue up 44%, pivoting from government to enterprise AI.

- Broadcom: $12B in AI revenue expected by year-end.

- HCL Technologies: A standout from India, riding the global talent wave.

The AI market is now worth $391 billion, with projections pushing that figure to $1.81 trillion by 2030—a 35.9% CAGR.

A Trillion-Dollar Operating System

Michael Dell’s proclamation of AI as the new OS isn’t hyperbole—it’s a reflection of how profoundly AI is reshaping economies, industries, and societies. From national policy to corporate strategy, from laptops to legislation, artificial intelligence is no longer a tool. It’s the infrastructure of the future.

And as the world pours trillions into that infrastructure, the question is no longer whether AI will transform the world—but how fast, and at what cost.