Airbnb vs. Booking Holdings Inc.: A 2025 Comparative Analysis

A comparative deep dive into Airbnb and Booking Holdings in 2025—exploring business models, financials, strategy, and investor appeal amid shifting travel and tech dynamics.

Airbnb and Booking Holdings Inc. are the dominant digital marketplaces in global travel, but they operate with distinct business models, growth strategies, and responses to post-pandemic shifts. As of August 2025, Booking Holdings is significantly larger in terms of market cap, operational scale, and service breadth. However, Airbnb’s asset-light, community-driven platform delivers differentiated tech innovation, strong user loyalty, and expanding margins. Both firms are profitable, well-capitalized, and highly innovative—yet they differ sharply in inventory mix, regional strengths, and strategic bets.

Online Travel: Trends and Dynamics

- Secular Growth: Post-pandemic recovery continues with record cross-border travel and strong consumer demand.

- Longer Stays & Remote Work: Both platforms benefit from the shift toward flexible travel and living arrangements.

- Alternative Supply: Growth in homes, “rare finds,” and urban hotels—particularly strong on Airbnb.

- AI & Digitalization: Booking is focused on AI, payments, and loyalty programs. Airbnb has overhauled its tech stack for faster rollouts, price transparency, and AI-powered support.

Competitive Backdrop

Booking Holdings is the global incumbent with wide vertical reach (hotels, flights, cars, dining), strong Asia-Pacific presence, and robust supplier relationships. Airbnb leads in consumer recognition for home sharing and alternative stays but competes in fewer property categories.

- Valuation: Booking trades at a premium due to its scale, diversification, and margins. Airbnb's valuation reflects higher organic growth potential, brand strength, and future margin upside.

- Strategy: Booking is building an integrated “connected trip” platform. Airbnb is investing in product, community, and lifestyle verticals.

- Investor Appeal: Booking appeals to GARP (growth at a reasonable price) and defensive investors. Airbnb attracts those who believe in marketplace network effects and premium brand equity.

Key Similarities and Differences

- Both are profitable, growth-oriented, and cash-generative, with large net cash war chests.

- Airbnb is more concentrated in homes and “alternative accommodations,” while Booking dominates in hotels and boasts global vertical integration.

- Booking emphasizes payments, loyalty, and AI integration. Airbnb focuses on product-layer innovation and brand extensions beyond homestays.

Key Business Segments & Revenue Mix

- Airbnb: 100% in “Stays/Experiences” (98% homes/apts, limited hotel inventory, and modest experience offerings).

- Booking Holdings: Hotels (core), alternative accommodations, flights, cars, dining/reservations, and advertising.

Company Overviews

Business Description & Scale

Airbnb, with a leaner team and a single flagship brand, runs a peer-to-peer marketplace focused on homes and unique stays. Its asset-light model drives high gross margins and strong free cash flow. Growth is strongest in newer markets, with a continued focus on usability and international expansion. However, its narrower scope and dependence on alternative accommodations position it more as a disruptor than a diversified incumbent.

Booking Holdings, with its multi-brand and full-stack ecosystem, enjoys broad travel coverage—spanning hotels, vacation rentals, flights, and dining. Supported by a significantly larger team, it captures a wider share of global travel demand and enjoys strong cross-sell opportunities. Booking’s merchant model, especially in alternative stays, has led to faster volume growth in nights booked than Airbnb. Data-rich platforms like Booking.com and Agoda enhance AI-driven personalization and deepen loyalty among both consumers and suppliers.

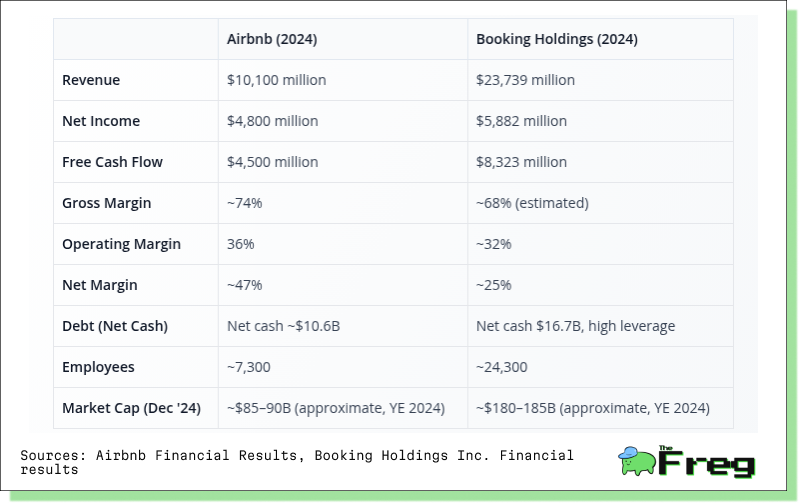

Recent Financial Highlights

Airbnb’s ability to convert a smaller revenue base into nearly equivalent net income is striking. With ~47% net margins and high free cash flow, Airbnb showcases the scalability of its business model. Booking, despite lower margins, operates with far greater revenue and cash flow, underlining its scale advantages and strategic reinvestment capability.

Stock Performance Comparison

Booking Holdings has outpaced Airbnb in 2025, with a YTD gain of +13.4% vs. Airbnb’s +2.5%.

Chart Insights:

- Booking Holdings: Steady momentum since April, supported by strong earnings, diversified offerings, and strategic execution.

- Airbnb: Volatile path with a February spike, March drop, and slow recovery—indicating investor caution around execution and regulation.

Key Insight:

This divergence shows a market leaning toward Booking’s scale and defensiveness, while Airbnb remains in a wait-and-see phase pending stronger global traction or operational clarity.

Strategic Positioning & Competitive Dynamics

Airbnb

- Strategic Focus: Enhancing core home rental experience, international expansion, and building out lifestyle offerings.

- Initiatives: AI-driven support, curated listings (“Guest Favorites”), price transparency, hotel inventory expansion, and app modernization.

- Sustainability: Promotes host-led growth and economic inclusion but faces rising regulatory scrutiny over housing and zoning laws.

Booking Holdings

- Strategic Focus: Creating a seamless “Connected Trip” ecosystem with integrated services across travel categories.

- Initiatives: AI/automation, mobile/app engagement, payment infrastructure, loyalty via “Genius,” and sustainable partner vetting.

- Sustainability: High compliance investment across Europe and Asia Pacific; ongoing regulatory negotiations.

Key Growth Drivers

- Airbnb: Emerging market expansion (LATAM, Asia), AI/product innovation, and adjacent verticals.

- Booking Holdings: Growth in direct bookings, APAC, loyalty programs, and full-trip ecosystem integration.

Material Risks

- Airbnb: Regulatory headwinds in urban housing and short-term rentals.

- Booking Holdings: Global tax, antitrust, and digital compliance pressures.

- Both: Macro risks including recession, inflation, and FX volatility.

Fundamentals & Return Profile

- Booking Holdings delivers sector-leading scale, profitability, and cash flow, reinforced by its diversified model and loyalty ecosystem.

- Airbnb stands out with strong brand equity, innovation, and high-margin growth in alternative accommodations—but faces higher execution and regulatory risk.

Bottom Line:

Both companies are long-term winners in travel digitization, but with contrasting paths: Booking offers global scale and efficiency; Airbnb offers network-led reinvention and lifestyle appeal.