AI, Energy, and the Great Power Recalibration

AI is reshaping global energy, driving massive demand while revolutionizing how power is generated, distributed, and intelligently managed.

The global energy sector is standing at the threshold of a transformative era—not solely because of the clean energy transition, but because of an unexpected catalyst: artificial intelligence. What was once seen as an abstract digital frontier is now a tangible force reshaping everything from electricity demand to investment flows.

At the heart of this convergence lies a paradox. AI is both a ravenous consumer of electricity and a revolutionary tool for managing and conserving it.

The New Power Appetite

AI's energy appetite is enormous—and growing. Data centers, the physical backbones of AI operations, are expected to consume 945 terawatt-hours (TWh) of electricity by 2030, according to the International Energy Agency. That’s roughly equal to Japan’s entire annual electricity consumption. In the U.S. alone, power demand from data centres is projected to rise by 20–40% over just the next two years.

This demand surge is catalyzing record-breaking deal flow. Already in early 2025, U.S. power sector M&A has topped $36 billion, led by Constellation Energy’s $16.4 billion acquisition of Calpine. And the capital waiting on the sidelines? A staggering $330 billion, poised for deployment in grid infrastructure, clean energy generation, and advanced storage technologies. Something which we had covered earlier here.

Smart Grids and Smarter Capital

AI isn't merely driving demand—it’s also optimizing the system that delivers the supply. Modern smart grids are increasingly powered by AI algorithms that can reroute electricity, detect maintenance issues before they escalate, and balance load distribution with precision that would be impossible for human operators alone.

The benefits are more than operational. According to the World Economic Forum, AI-enabled smart grids and efficiency technologies could deliver $1.3 trillion in economic value by 2030 while slashing global emissions by as much as 10%. For ESG-focused investors, that combination of financial return and environmental benefit is hard to ignore.

Renewables: Reinvented by AI

Nowhere is this synergy more apparent than in renewable energy. More than 70% of solar assets underperform their projected output. That inefficiency represents not just a technological shortfall but a massive financial one. Enter AI-powered platforms like Austin-based enSights, which recently raised $10 million to tackle this challenge head-on.

By analyzing performance data across 6,000 solar installations worldwide, enSights and similar startups are helping operators unlock hidden value in their portfolios. Investors, too, are starting to realize that the true value of renewables lies not just in hardware—but in the software that makes them work smarter.

Nuclear Makes a Comeback

Surging AI-driven electricity demand is even reviving the long-dormant nuclear sector. Tech giants like Amazon, Microsoft, and Google are now placing strategic bets on next-generation nuclear technology, including small modular reactors (SMRs) built specifically to power data centers.

Amazon’s investment in X-energy and Microsoft’s electricity procurement from the formerly decommissioned Three Mile Island facility are just the beginning. With backing from the Department of Energy, X-energy plans to deploy four reactors at Dow’s Seadrift site in Texas by 2030. Once considered too complex and politically risky, nuclear energy is quietly becoming a strategic pillar in the AI-era energy portfolio.

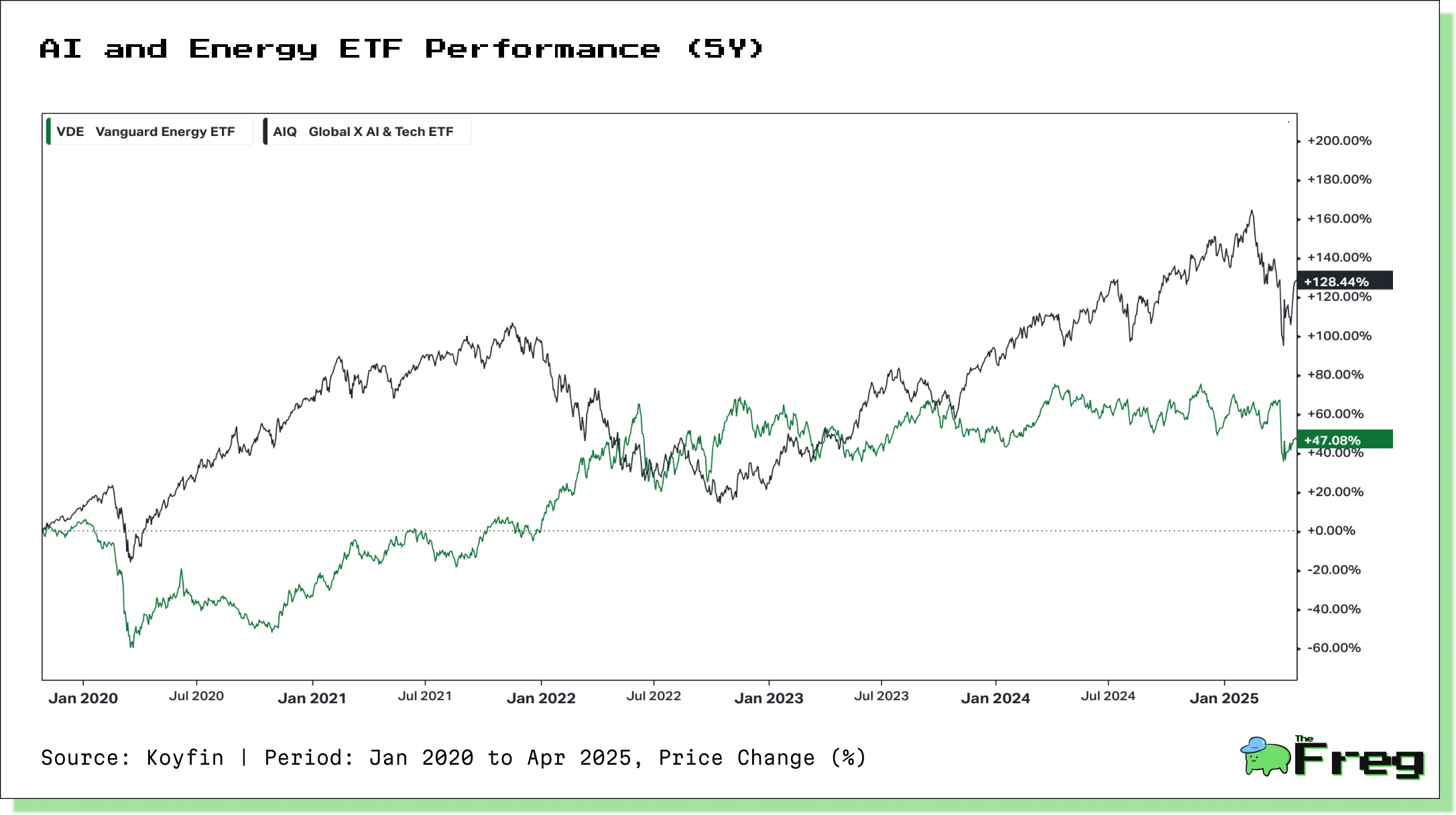

A New Investment Theme Emerges

The convergence of AI and energy is giving rise to thematic investment opportunities across four primary fronts:

- Digital infrastructure: Data centers are projected to consume 4% of global electricity by 2030, accelerating the need for grid modernization.

- AI-optimized renewables: Firms improving renewable forecasting and performance through AI are attracting major funding rounds.

- Energy efficiency tech: With computational power for AI doubling every 100 days, energy-efficient systems are no longer optional—they're essential.

- Microgrids and decentralization: Smart cities and disaster-resilient infrastructure are driving adoption of localized power systems, often powered by renewables and managed by AI.

In 2023, despite a broader tech funding slowdown, AI startups still raised over $42.5 billion across 2,500 equity rounds. Meanwhile, clean energy investment surpassed $3 trillion globally in 2024—with $2 trillion going specifically into renewable generation, transmission, and storage technologies.

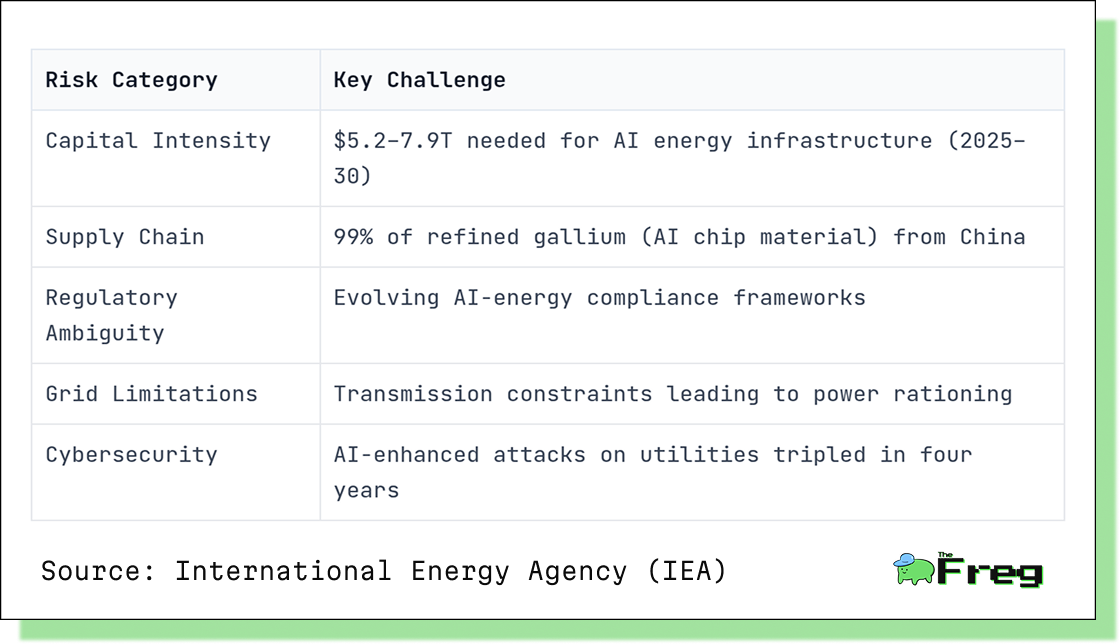

Risks on the Radar

Yet this transformation isn’t without friction. Several significant challenges loom:

AI’s impact on the energy sector is not just about higher electricity bills or faster servers—it’s about a wholesale reinvention of how we power the world.

For policymakers, the challenge is to keep pace with the speed of innovation. For investors, the opportunity lies in picking the winners that will define this new era. And for the energy industry itself, the message is clear: adapt quickly, or be left in the dark.