Adani’s Big Bet on Airports and Infrastructure: A High-Stakes Push Toward 2027

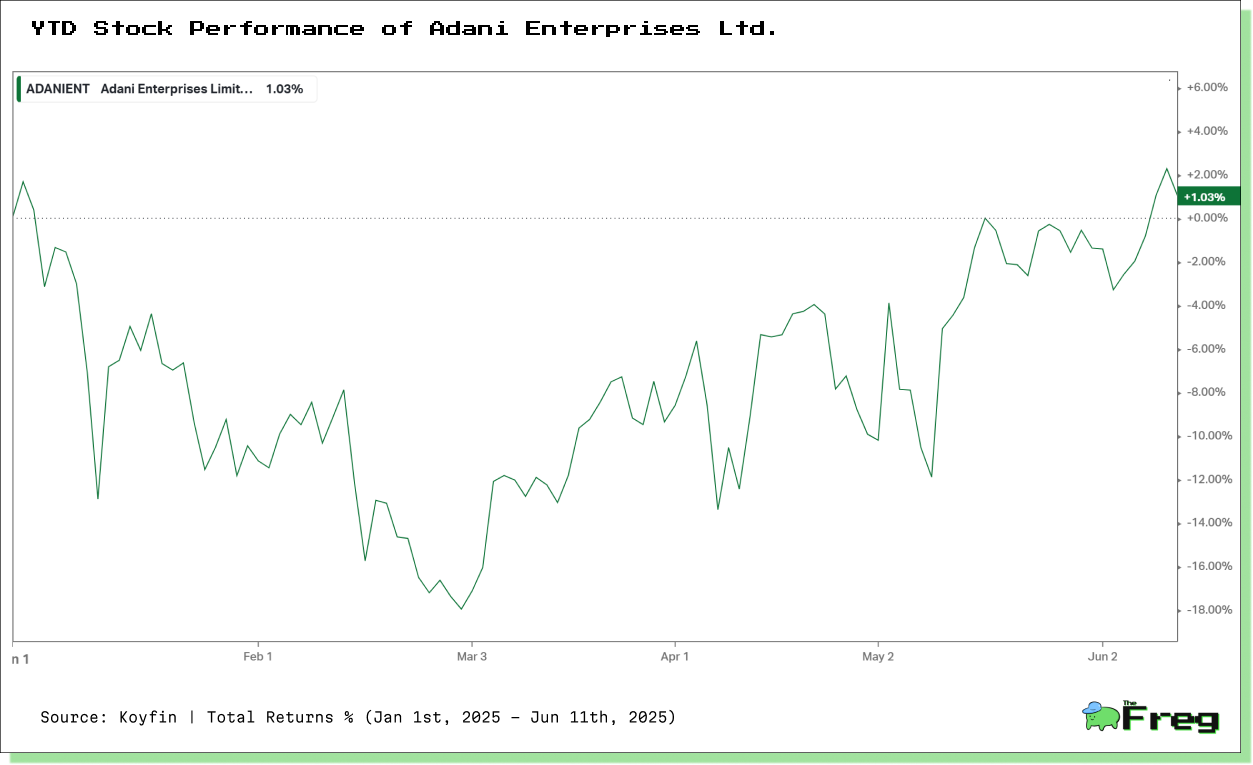

Adani Group is fast-tracking a $100B capex plan and preparing to list its airport unit by 2027. This bold strategy signals its post-crisis revival, aligning with India’s infrastructure ambitions and testing investor confidence in privatized assets.

Billionaire Gautam Adani is accelerating his conglomerate’s return to the spotlight with a twin-pronged strategy: a public listing of Adani Airport Holdings Ltd. (AAHL) by March 2027 and an expedited $100 billion capital expenditure (capex) plan across energy, logistics, and infrastructure. These moves mark a bold resurgence after a turbulent period dominated by allegations and scrutiny, and they could reshape India’s infrastructure and capital markets alike.

From Demerger to Market Debut: The Airport IPO Strategy

Adani Airport Holdings, currently a subsidiary of Adani Enterprises Ltd., is being prepared for a demerger, with the goal of independent operations by FY2027–28. According to Group CFO Robbie Singh, the spin-off hinges on three pillars:

- Financial self-sufficiency,

- Independent governance, and

- Sustainable investment capacity.

This isn’t a mere financial reshuffling. It’s a strategic pivot that underscores the group’s intent to make airports a core growth engine. Operating eight airports across India, including Mumbai’s international gateway, AAHL is expected to be the first major business unit to go public as part of the group's broader asset monetization plan.

The Capex Race: $100 Billion in 5 Years

Adani’s infrastructure ambitions are being supercharged. What was initially projected as a 10-year capex roadmap has now been compressed into just 5–6 years, underscoring the group’s urgency to stake its claim in India’s infrastructure supercycle. The funding model for this massive investment plan is as follows:

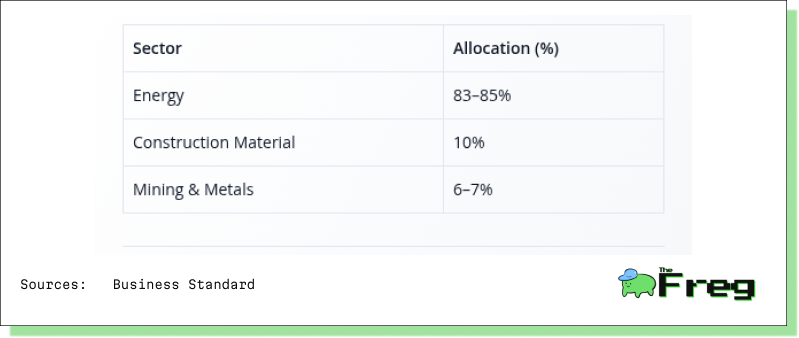

The lion’s share of investments—83–85%—is earmarked for energy infrastructure, particularly renewable energy generation and storage. 10% will go to construction materials, and 6–7% toward mining and metals.

This aligns Adani’s growth strategy with national programs like PM Gati Shakti and the National Infrastructure Pipeline, blending private execution capacity with public infrastructure goals.

Reclaiming Momentum: From Allegations to Aggressive Expansion

After the 2023 Hindenburg Research report accused Adani Group of “stock manipulation and accounting fraud,” followed by a U.S. Department of Justice probe on bribery, the conglomerate suffered a $130 billion market cap erosion. Yet the group has rebounded swiftly, with Gautam Adani making his first major overseas trip since the controversies—visiting China to secure industrial equipment for the group’s ventures.

Critically, the Supreme Court-appointed panel found no regulatory lapses or price manipulation, although MSCI ESG Research continues to flag governance risks. Transparency and accountability will be central to investor confidence—particularly ahead of the airport unit’s IPO.

Aviation as a Test Case for Privatization

Adani’s control of Mumbai International Airport and six others, acquired through a government bidding process in 2019, made it the country’s largest private airport operator—despite having no prior aviation experience. Aided by relaxed regulatory norms, Adani scaled its aviation footprint rapidly, showcasing how private firms can successfully manage national infrastructure assets.

The planned IPO of AAHL could serve as a proof-of-concept for the National Monetisation Pipeline, validating that privatized infrastructure can generate stable returns. With passenger handling capacity expected to triple to 300 million annually by 2040, Adani is betting big on India’s aviation growth story.

Infrastructure Investment as National Imperative

The significance of Adani’s infrastructure push extends well beyond corporate growth. It represents a private sector-led model of infrastructure development at a time when India is positioning itself as a manufacturing and logistics hub to rival China. The $16 billion expected return on capital from this capex cycle further underlines the commercial viability of such long-term projects.

This aggressive spending pattern not only boosts national infrastructure but sets a benchmark for other industrial giants—domestic and global alike—to follow.

The Bigger Picture: Strategic Inflection Point

Adani’s airport IPO and its $100 billion investment plan signal more than corporate ambition—they are a litmus test for India’s privatization and infrastructure trajectory. The stakes are high: while success could unlock new avenues of foreign and domestic capital, any missteps in governance or execution could sour investor sentiment across India’s infrastructure sector.

Recent signs are encouraging. Global institutional investors like BlackRock and DBS Group have begun re-engaging with Adani companies. A $750 million raise for the airports business points to a cautious yet growing vote of confidence.

As India eyes the $1.4 trillion infrastructure investment target by 2025, the Adani Group may well be the fulcrum around which this vision pivots. But credibility and execution, not just capital, will ultimately determine the outcome.

Adani’s bold airport IPO plan and compressed infrastructure capex timeline represent a calculated gamble on India’s future. If the group can rebuild trust and deliver returns, it won't just secure its own future—it could redefine the role of private enterprise in India’s development story.