3M in 2025: A Strategic and Financial Analysis

3M’s 2025 turnaround gains traction post-healthcare spin-off, with strong margin recovery, disciplined capex, and investor optimism—despite ongoing legal and macro risks.

3M steps into the second half of 2025 as a redefined industrial technology powerhouse. With its Health Care business spun off, the company is now laser-focused on its core segments—Safety & Industrial, Transportation & Electronics, and Consumer. Even as it contends with muted demand in some sectors and persistent litigation pressures, 3M’s strategic playbook centers on streamlining operations, enforcing cost discipline, and untangling legacy liabilities. While its legal settlements and the tail-end of its PFAS exit continue to cast shadows, they’re juxtaposed against signs of real operational progress—setting a cautious but increasingly optimistic tone for forward-looking investors.

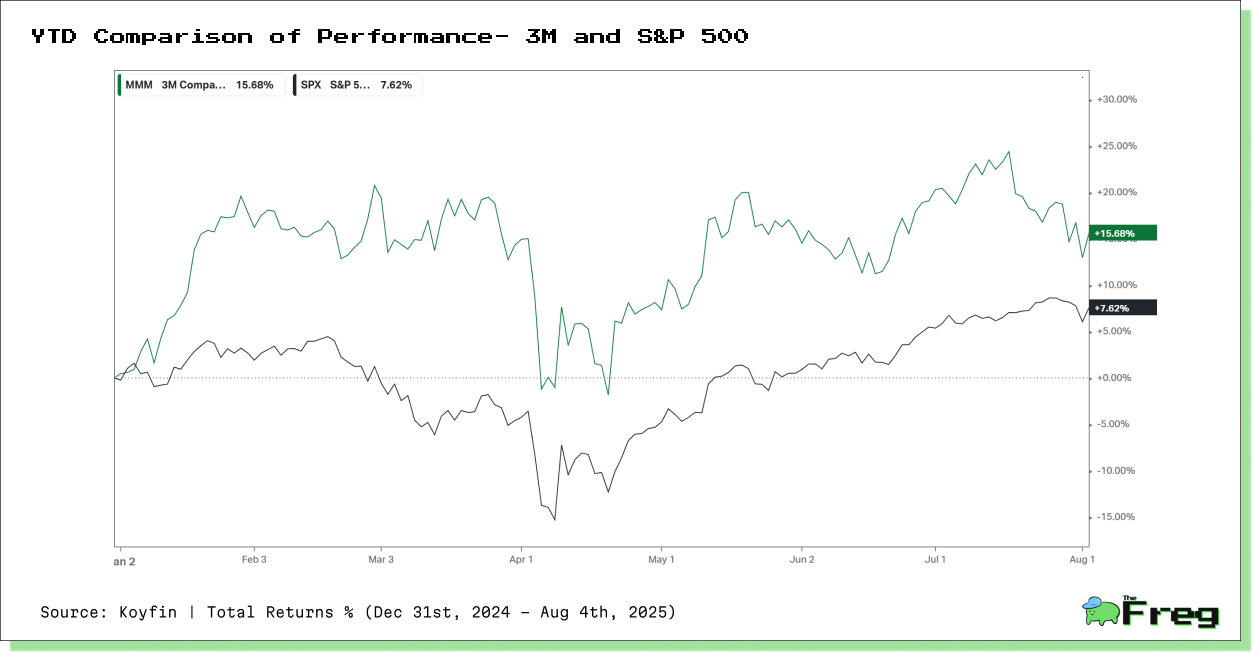

Stock Trajectory: 3M vs. the Benchmark

The graph tracks how 3M’s stock fared against the S&P 500 during the first seven months of 2025. Kicking off the year on even ground with the index, 3M (MMM) surged ahead in early Q1, peaking with gains over 25%, while the S&P 500 lingered around a 5% uptick.

But from late March into April, 3M took a sharp tumble—about 15%—a dip more severe than the broader market pullback. This drop appears to have coincided with both macro turbulence and internal headwinds, including litigation concerns and operational developments.

Yet, 3M didn’t stay down for long. It rebounded with force, steadily outperforming the S&P 500 in the months that followed. By late July, 3M had delivered a total return of +14.7%, outpacing the S&P 500’s +8.18% by roughly 6.5 percentage points year-to-date.

This performance suggests that despite periods of volatility, market confidence in 3M’s turnaround story is growing. Its outperformance hints at positive investor sentiment surrounding restructuring progress and successful risk management—even against a complex macroeconomic backdrop.

In short: 3M has shown impressive resilience and delivered a strong rebound, outpacing its industrial peers and reinforcing optimism in its ongoing transformation.

Segment-Level Drivers and Margins

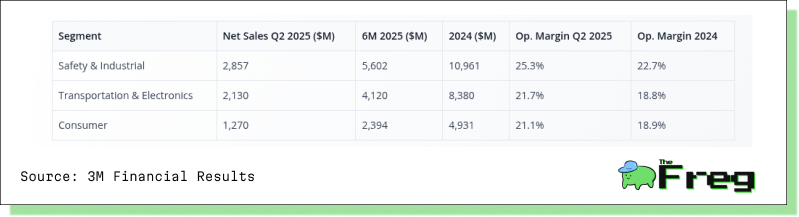

3M now operates across three core business segments, each showing varied momentum through 2025:

- Safety & Industrial: Contributing 44.6% of 2024 sales, this segment held steady with demand in electrical markets and adhesives, though automotive aftermarket softened. Operating margins improved, helped by cost cuts and fewer restructuring costs.

- Transportation & Electronics: Making up 34.1% of 2024 sales, this segment faced pressure from PFAS product wind-downs and weakness in auto OEMs. Still, commercial graphics and aerospace provided resilience. Margins are recovering from past dis-synergies.

- Consumer: Representing 20.1% of 2024 sales, consumer demand remained soft in discretionary areas, but showed gains in home improvement and safety-related products. Margins climbed thanks to stronger advertising, productivity gains, and restructuring.

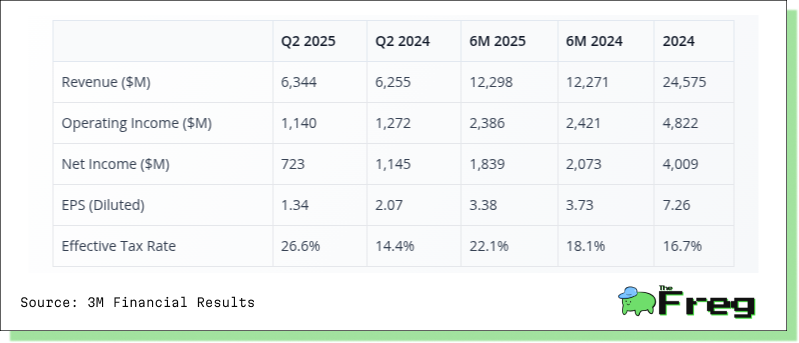

Financial Snapshot: Revenue Stability, Margin Headwinds

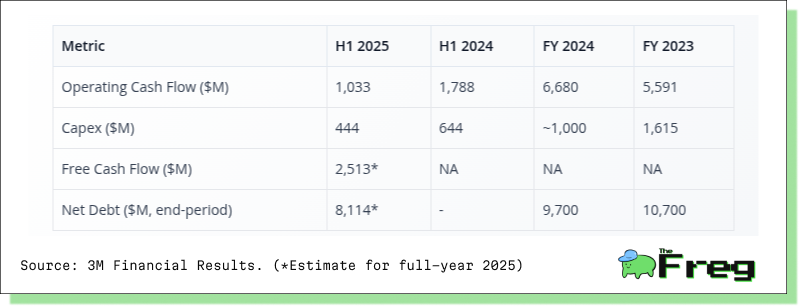

Operating cash flow for the first half of 2025 came in at $1.033 billion, down sharply from $1.788 billion in H1 2024. The primary culprit? $3.1 billion in litigation-related cash outflows tied to legacy PFOA and Combat Arms Earplugs cases. Core operations remained solid, but cash flow took a hit.

Capital expenditures were tightly controlled at $444 million, versus $644 million the previous year—focusing mainly on automation, safety, and sustainability. Full-year capex is projected at $1.0 billion as restructuring continues.

Free cash flow for the year is pegged at $2.5 billion, with expectations of improvement in 2026 and 2027 as settlement costs decline and efficiencies build. Net debt stood at $8.1 billion midyear, reflecting the burden of litigation and shareholder returns. The plan: gradual deleveraging as liabilities ease. Cost of sales improved to 57.5% of revenue in Q2 thanks to procurement wins and restructuring.

While strong fundamentals shine through, the drag from exceptional items like legal settlements and divestitures is still visible. On a trailing twelve-month basis, net sales held steady at $24.6 billion, flat year-over-year after accounting for the Health Care spin-off and PFAS exits. Q2 2025 GAAP operating income was $1.14 billion (18.0% margin), with adjusted margins rising to 24.5% after excluding special items.

These figures highlight a company showing early gains from restructuring while navigating elevated taxes and legal costs.

Cash Flow Trends

H1 2025 operating cash flow landed at $1.0 billion, down meaningfully due to $3.1 billion in settlement-related payouts for the PWS and CAE cases. Capex stayed disciplined at $444 million, targeted at automation, safety, and sustainability. Free cash flow is estimated at $2.5 billion for the year, with a recovery path charted for 2026 and 2027.

Efficiency is improving. Cost of sales dropped to 57.5% of revenue in Q2—another sign of restructuring gains starting to take hold.

Risk Landscape

Here’s what investors are watching:

- Legal/Environmental: PFAS liabilities remain material, with more payments due through 2026–27. Regulatory risks persist.

- Restructuring Execution: Ongoing cost cuts, especially internationally, carry transition risks. Missed targets could hurt margins.

- Demand Weakness: Industrial production, auto, and consumer discretionary segments remain sluggish, risking top-line momentum.

- Credit Profile: Leverage remains high—$3.9 billion in equity vs. $36.0 billion in liabilities. Any downgrade or rate hike could sting.

- Global/geopolitical: Supply chain swings, trade barriers, and FX volatility pose ongoing threats.

- Pension/Postretirement: Market shifts or policy changes could raise funding obligations.

- Post-spin Transition: While the Solventum spin-off is done, commercial, supply, and tax integration risks remain.

3M is navigating a turning point—exiting a period defined by legal turbulence and business restructuring. The outlook is cautiously constructive:

Strengths:

- Strong core operations, with improving margins and smart capital use.

- Litigation risks are increasingly defined and priced in.

- Cost discipline could drive margins higher as markets recover.

- Shareholder returns remain solid, with buybacks and a sustainable dividend.

Challenges:

- Growth will likely be muted near term, with industrial cycles still soft.

- Environmental and product litigation risks linger.

- Post-spin equity base is thinner, which may pressure ROE optics.

The bottom line:

3M is a seasoned industrial giant with real self-help potential. The worst of the storm appears behind it—but investors should stay vigilant for continued margin progress and risk control. For long-term holders, the stock offers steady capital return, upside from cyclical recovery, and embedded value—albeit with higher risk than its legacy profile.